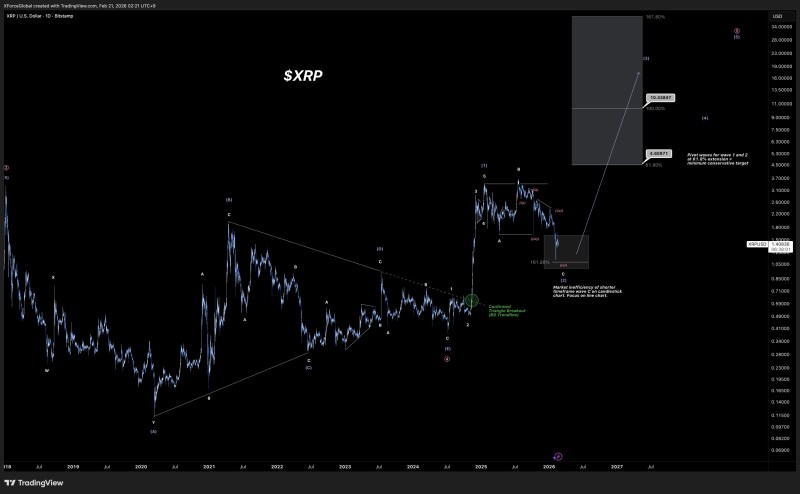

⬤ XRP's price structure looks solid right now, showing clear wave formations and Fibonacci levels that support higher targets ahead. Maintains strong conviction for upward movement, with minimum targets sitting between $4 and $10. The charts show a confirmed breakout from years of consolidation, plus a developing impulse wave that fits perfectly with Elliott Wave theory.

⬤ Looking at the daily timeframe, you can see a complex correction that's broken upward, confirming the bullish shift everyone's been waiting for. The waves follow textbook Elliott patterns - clean 5-wave advances paired with 3-wave pullbacks. Key Fibonacci extensions mark crucial zones around $4.60 (61.8%) and $10.43 (100%), suggesting XRP could revisit and push past major resistance areas. Similar bullish setups appear in XRP Price Analysis: Targeting $27 After Decade-Long Breakout, which explores even higher Fibonacci targets beyond current ranges.

⬤ What really matters here is keeping structure above those corrective lows. After grinding through a long correction, the breakout zone now acts as the pivot for continuation. "The macro outlook still shows strong conviction for higher price levels," notes the analyst, emphasizing how the triangle breakout and emerging impulse structure reinforce the bullish case. This momentum aligns with patterns discussed in XRP Price Analysis: Is an Explosive Breakout Ahead?, which details rising momentum targeting $8-$12.

⬤ The real significance comes from how traditional wave theory lines up with Fibonacci extensions - as long as XRP holds critical support, the broader trajectory stays pointed up. These technical developments might shift sentiment across crypto markets, since XRP's behavior reflects clear pattern recognition rather than random chaos. Breaking cleanly above resistance could push momentum toward the higher targets, while losing pivotal levels would force a reassessment. Additional context on these Fibonacci zones appears in XRP News: Price Analysis Shows Fibonacci Extensions Target $4-$6 Zone, highlighting how extensions map probable upside consistent with current analysis.

Usman Salis

Usman Salis

Usman Salis

Usman Salis