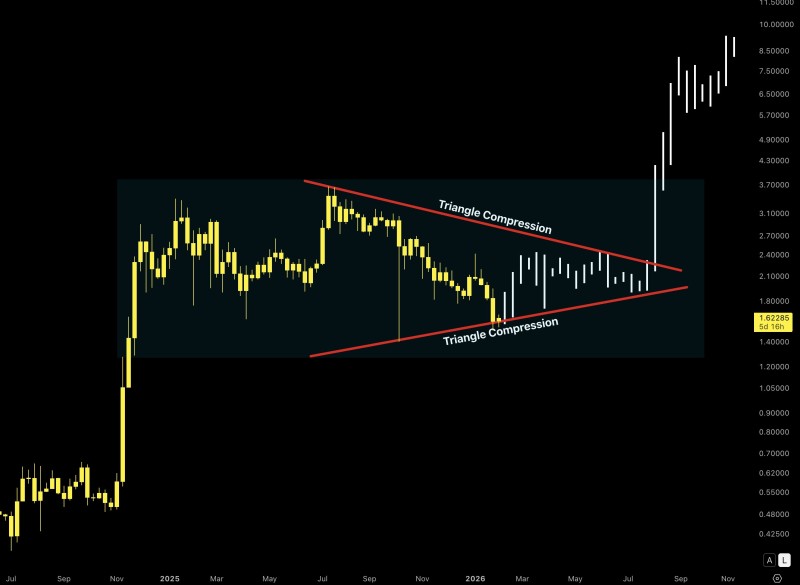

⬤ XRP's trading inside a massive consolidation box after its strong run in late 2024, with price squeezed between converging trendlines. The chart shows XRP respecting descending resistance while holding a clear support zone around $1.60, where recent candles have been clustering after testing lower levels earlier this year.

⬤ The likely low came somewhere in the $1.30-$1.50 range, lining up with that April 2025 wick that's now been filled. Since then, it's been textbook triangle action—lower highs hitting resistance, higher lows bouncing off support. This squeeze shows declining volatility and nobody's really in control yet, with neither bulls nor bears able to punch through.

⬤ Weekly Stochastic RSI and MACD have been camping out in oversold territory for a while now, pointing to a long reset rather than any quick snap-back. The continued compression suggests XRP might keep drifting sideways for several more months, slowly draining selling pressure while keeping that structural support intact.

⬤ Extended consolidation phases like this often set up big directional moves down the road. The longer the compression, the weaker short-term sentiment gets, but the stronger the technical foundation becomes. With XRP holding above its established low zone and respecting triangle support, this setup's asking for patience—the next major expansion phase probably won't show up until second half of 2026.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah