XRP (Ripple) has caught traders' attention again as new liquidity mapping shows a major accumulation of leveraged positions clustered above the $3.6 mark. This concentration could become a critical pivot point - if buying momentum takes hold, it might spark a quick upward move as positions get liquidated in sequence.

Liquidity Reveals Market Pressure Points

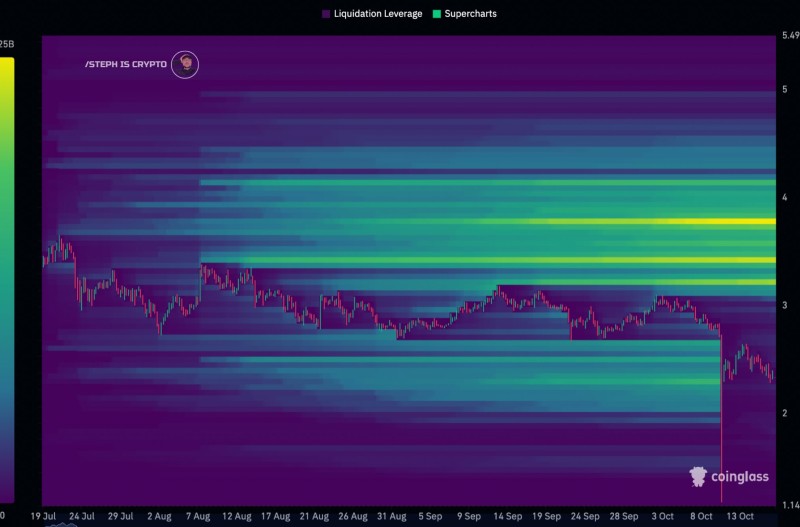

A recent analysis from trader STEPH IS CRYPTO showcased a liquidity heatmap displaying heavy clustering above $3.6. These zones typically mark areas where stop orders and leveraged trades pile up, creating conditions for sudden price shifts once the market tests those levels.

The chart shows XRP consolidating after a sharp drop, with clear heat zones sitting above current prices. That dense liquidity near $3.6 means a sustained rally could set off a chain reaction of orders, driving the asset higher in short order.

Price Action Shows Shakeout Pattern

XRP has been bouncing between $2 and $3 lately, facing selling pressure around $2.5. But the heatmap makes it clear the real resistance sits higher, clustered near $3.6 and beyond. This pattern often reflects a shakeout period where weaker hands get flushed out during dips. Once that phase wraps up, the remaining players can push price upward, potentially igniting large-scale liquidations that fuel further momentum.

Broader Market Forces at Play

XRP's 2025 trajectory isn't just about technicals - it's also shaped by regulatory news and its growing use in institutional payment networks. While uncertainty persists, liquidity maps give traders a practical way to spot high-volatility zones ahead of time. With Bitcoin dominance climbing and capital starting to rotate into altcoins, XRP stands to benefit if overall crypto sentiment improves. The asset has historically shown it can rally hard once it breaks through key liquidity barriers.

What Traders Should Watch

The $3.6 liquidity cluster now stands as a crucial technical threshold. If XRP builds enough momentum to reach that zone, a cascade of forced liquidations could push prices significantly higher, potentially revisiting multi-year peaks. On the flip side, if momentum fizzles out, XRP might stay trapped in its current range, prolonging the consolidation phase. The big question now is whether XRP can gather enough strength to break through that liquidity wall at $3.6 - or if it stalls out before reaching it.

Sergey Diakov

Sergey Diakov

Sergey Diakov

Sergey Diakov