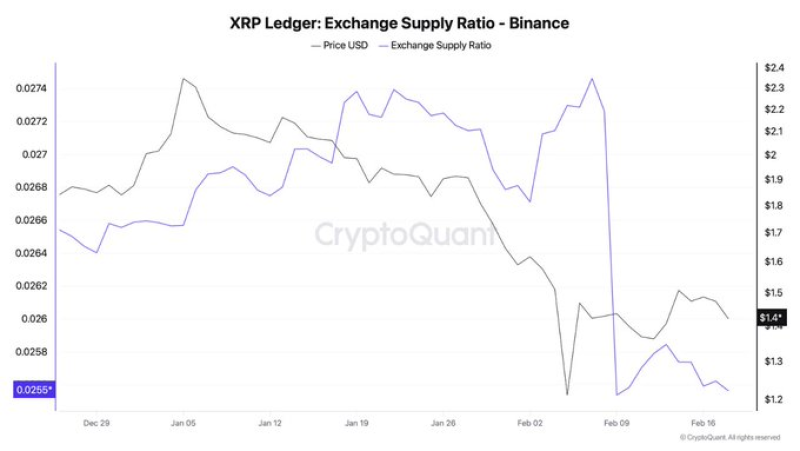

⬤ XRP is trading near $1.40 while on-chain metrics point to a noticeable shift in exchange balances. The XRP Exchange Supply Ratio on Binance just hit multi-month lows, dropping toward roughly 0.0255 at the same time price remains under pressure.

⬤ The exchange supply ratio shows how much XRP sits on Binance compared to total circulating supply. When this number drops, it usually means tokens are being pulled off the exchange, cutting down the amount of liquid supply available for immediate selling. The chart reveals the metric falling while XRP price trends down toward the $1.4 zone over the same period.

⬤ Exchange outflows often get framed as a potential accumulation signal since coins leaving exchanges are less likely to be dumped quickly. However, the data doesn't confirm who's buying or why, and price can stay weak even when exchange balances drop. Still, the combo of lower exchange-held supply and a beaten-down price has traders wondering if the market's entering a redistribution phase.

When the ratio falls, it typically means tokens are being withdrawn from the exchange, reducing the amount of immediately liquid supply available for selling.

⬤ If reduced exchange supply holds, it could shift liquidity conditions and amplify price moves when demand kicks back in, while also making XRP more sensitive to broader market swings. Right now, traders are watching whether Binance XRP reserves dropping continues and if price action changes as liquid supply tightens across major venues - a dynamic echoed in narratives around XRP supply leaving exchanges tracked across the market.

⬤ The situation also ties into broader accumulation patterns, with recent data showing XRP whale accumulation wave activity as midtier wallets add to positions. Whether this translates into sustained upside will depend on how long the supply squeeze lasts and whether macro conditions turn supportive.

Peter Smith

Peter Smith

Peter Smith

Peter Smith