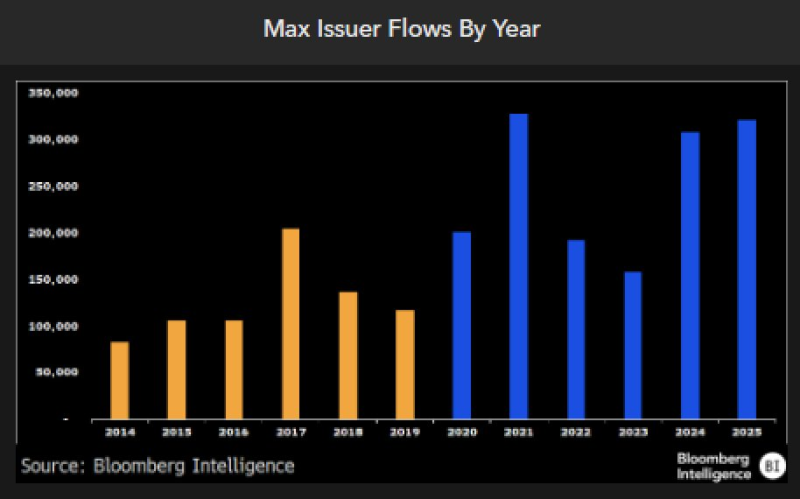

⬤ Vanguard has pulled in $326 billion in ETF flows year to date, putting it within striking distance of breaking its 2021 record of $328 billion with six weeks still left in the year. That works out to roughly $1.5 billion flowing in every single day. The momentum shows just how dominant the firm remains in the ETF space, even as the industry experiments with more niche product launches. What's driving the surge? Mostly Vanguard's bread-and-butter approach—broad market exposure at rock-bottom fees.

⬤ The Vanguard S&P 500 ETF (VOO) is crushing it on its own, currently sitting at about $108 billion in inflows and on pace to shatter its previous annual record. VOO's performance mirrors the wider story: investors keep piling into simple, diversified, low-cost index funds. The shift toward passive investing isn't slowing down—it's accelerating. Since 2020, ETF inflows have jumped to a completely different level compared to the 2014-2019 period, and 2025 is tracking close to $350 billion across the industry.

⬤ Vanguard has now claimed the top spot for asset gathering six years running, a streak that highlights how central the firm has become to ETF growth. While other issuers chase trends and launch experimental products, Vanguard keeps winning by sticking to what works: giving people cheap, reliable access to the market. With flows already near all-time highs and several weeks left in the year, Vanguard's dominance in the ETF market shows no signs of fading.

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova

Marina Lyubimova