TRON (TRX) is showing strong signs of accumulation as USDT activity surges and stablecoin supply reaches new heights. Currently trading at $0.125, the crypto could be gearing up for its next major move.

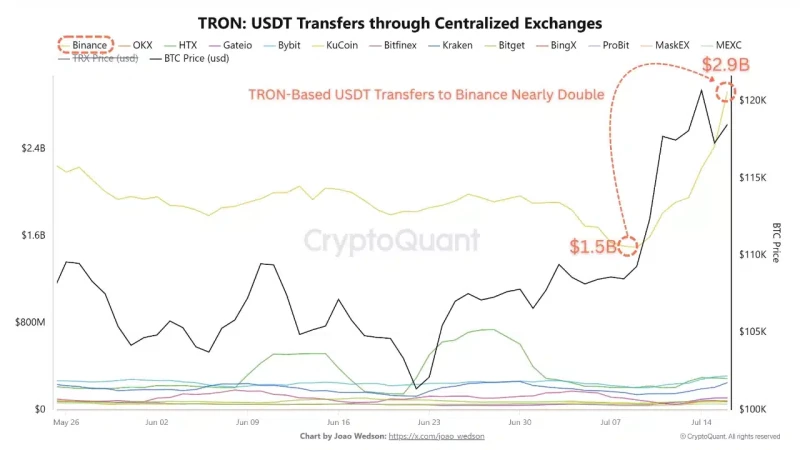

TRON (TRX) Price Action: Exchange Flows Jump 93% in One Week

USDT transfers through TRON to centralized exchanges just went crazy - jumping from $1.5 billion to $2.9 billion between July 9th and 16th. That's a massive 93% spike that has everyone talking.

Binance is handling 70% of this volume, which shows it's become the main hub for TRON-based stablecoin trading. When you see this much money flowing into exchanges, it usually means traders are positioning for something big.

This kind of sharp increase in on-chain activity typically signals bullish intentions, especially when TRON's network fundamentals remain solid. With TRX sitting at $0.125 right now, this could be the setup phase before a major price movement.

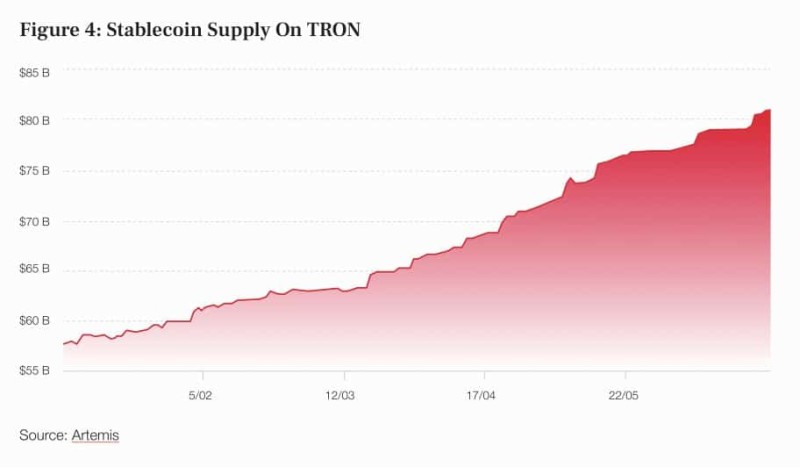

TRON's $80B Stablecoin Empire Fueling TRX Price Growth

TRON just hit a huge milestone - its total stablecoin supply crossed $80 billion, making it one of the biggest stablecoin infrastructures in crypto. This isn't just impressive on paper; it shows real adoption.

People love TRON because it's fast and cheap for moving USDT around. During volatile market periods like these, traders flock to networks that won't eat up their profits with high fees. TRON delivers exactly that.

This growth reflects genuine network usage and trust, which historically drives TRX price higher. As more users need high-speed, low-cost transactions, TRON is perfectly positioned to benefit from this demand.

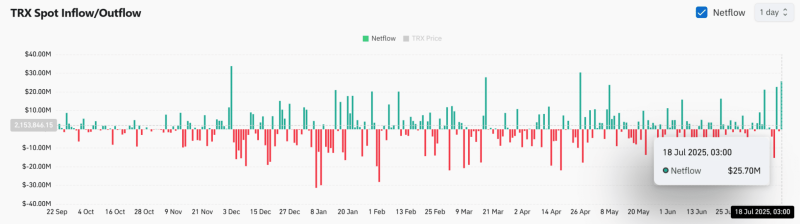

TRX Accumulation: $25.7M Inflows Signal Smart Money Interest

Here's where things get interesting. TRX just recorded $25.7 million in net inflows, completely flipping from the negative trend we saw recently. This positive flow usually means investors are quietly accumulating.

Looking at past patterns, sustained inflows like this often happen right before price rallies, especially when combined with strong ecosystem growth like TRON's stablecoin expansion.

While inflows alone don't guarantee a breakout, they add to the bullish picture when paired with increased exchange activity. Smart money tends to move first, and this capital shift into TRX could be early positioning ahead of a rally.

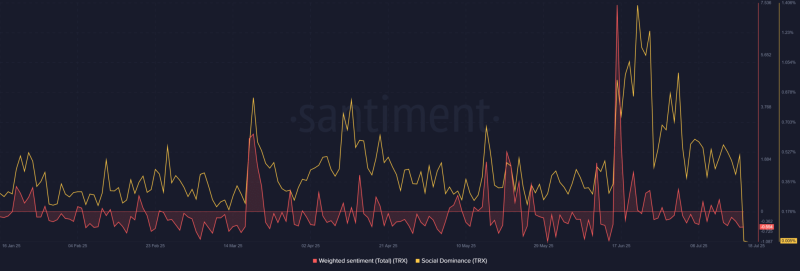

TRX Price vs Sentiment: Why Bears Might Be Wrong

Despite all this positive activity, TRX sentiment remains negative at -0.55, and social dominance dropped to just 0.005%. Basically, retail investors aren't excited about TRX yet.

This creates an interesting situation where strong fundamentals meet weak crowd sentiment. History shows these mismatches often precede recovery phases as skepticism slowly fades.

The bearish perception might actually be good news for contrarian investors who focus on metrics rather than social media hype. When everyone's bearish but the data looks bullish, that's often when the best opportunities emerge.

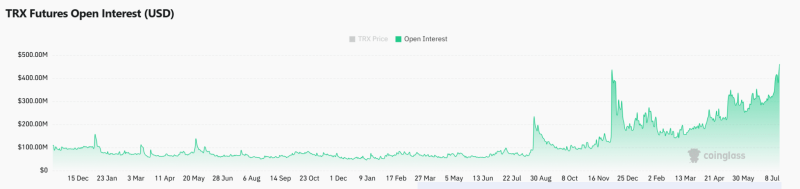

Rising TRX Open Interest Points to Major Move Ahead

TRX's Open Interest surged 18.8% to $517.33 million, showing traders are positioning for volatility. This metric tells us leveraged trading activity is heating up.

When combined with stablecoin accumulation and positive netflows, this OI spike looks bullish. It shows growing anticipation and capital deployment into TRX futures as traders wait for breakout confirmation.

TRON's momentum is building across multiple fronts - record $80B stablecoin supply, surging exchange inflows, and rising Open Interest. Despite weak sentiment, the combination of network growth and accumulation suggests strategic positioning is happening behind the scenes.

If these trends continue, TRX could be on the verge of a significant breakout as investors start following the data instead of market noise.

Usman Salis

Usman Salis

Usman Salis

Usman Salis