TON sits at a critical support level where a $400M treasury partnership could trigger a 21% rally, but mixed on-chain signals suggest caution.

TON is having one of those moments where everything could go either way. The token's been stuck in a downtrend for a year, with $6.80 being its highest point, but now there's some serious institutional money coming in that could change things.

The TON Foundation just partnered with Kingsway Capital to launch a $400M Toncoin treasury company. That's real money, not some vaporware announcement. Combined with TON only climbing 1.77% in the last 24 hours, it feels like the calm before either a storm or a rally.

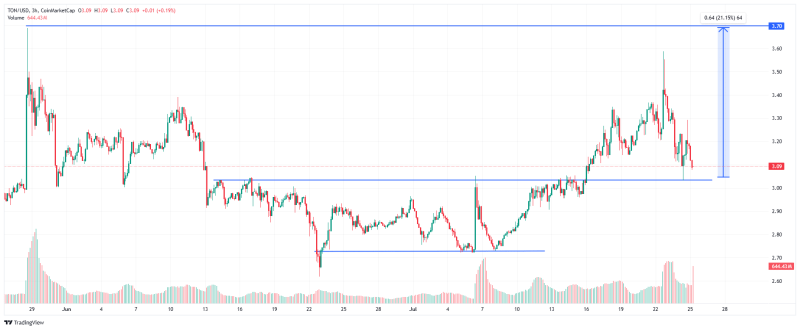

Here's the setup: TON has been bouncing between $2.60 and $3.70 for two months. The price dropped from $3.7 towards the end of May to the low of the range a month later – that was a major turning point. Then it broke above $3 and surged to almost $3.6, but has since retraced and already rejected the $3 level once.

As long as Toncoin holds above its bullish structure, higher levels could be reclaimed. The weird part? Its TVL has been dropping over the past year, but this corresponded with on-chain activated wallets rising.

TON (Toncoin) Faces Make-or-Break $3 Level

This is where it gets interesting. If TON holds above that $3 support level, the $400M treasury news could fuel a rally of about 21%, setting a target at $3.70. But if it breaks down? A breach and a hold back into the consolidation zone could pull the altcoin down even further.

The on-chain data is telling a mixed story. With the total supply of TON standing at 5.135 billion and fees dropping, it suggests token usage has declined. Average on-chain wallet activations per day dropped by almost 50% in 10 days – from 35,392 down to 19,366.

But here's the flip side: total accounts and overall activated wallets seemed to be hitting new peaks. So daily activity is down, but the user base is still growing. There were some positives though – assets and valuables with NFTs and DNS trading volumes climbed to 23.37M and 7M TON, respectively. These metrics can be expected to rise now that TON's wallet has officially launched for the U.S market.

TON (Toncoin) DeFi Shows Concerning Trends

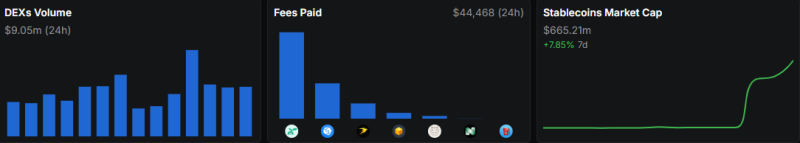

The DeFi picture is honestly pretty concerning. The staked TON stood at 791M while the stablecoin market cap rose by 7.85% over the last seven days, which sounds okay until you dig deeper.

The Total Value Locked (TVL) has dropped by more than 2.5x over the past one year. Back in July 2024, the TVL was $1.1 billion. Right now, it's closer to $408M. That's a massive decline that can't be ignored.

The last three days maintained the average 24h DEX volume at about $9M from this week's high of $15M. Among protocols on TON network, TONCO led by fees paid (roughly $17,432) – more than the combined value of STON.fi, Storm Trade and DeDust.

All these metrics together mean TON's price is at a crossroads right now. The $400M treasury is definitely bullish news, but the declining TVL and mixed user activity show the ecosystem has some serious work to do.

Hence, there is no certainty that it will meet its price target and hike by 21%. Sometimes in crypto, all you need is one big catalyst to flip the script entirely. That treasury deal could be it – but only if the technicals cooperate and that $3 level holds.

Peter Smith

Peter Smith

Peter Smith

Peter Smith