While XLM's price chart looks rough, something interesting is happening beneath the surface. The twist? This happened while the token's price got cut in half since December. The disconnect is striking—investors may be stepping back, but builders and users on the network are doubling down.

The Numbers Tell a Different Story

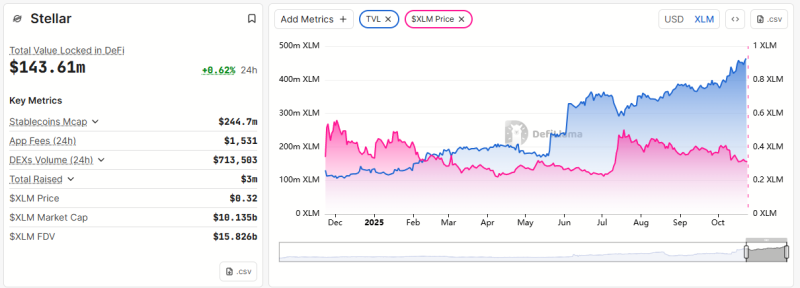

Stellar's total value locked in DeFi has climbed to a record 456 million XLM, according to data shared by STEPH IS CRYPTO. Current data shows Stellar's TVL at $143.61 million, up 0.62% in 24 hours, while XLM trades around $0.32 with a market cap of $10.13 billion. The chart reveals the split personality: the blue TVL line keeps climbing through 2025 while the pink price line slides downward. This isn't weakness—it's a sign that real activity is growing independent of market sentiment.

The expanding DeFi infrastructure on Stellar, from liquidity protocols to stablecoin integrations, is pulling in long-term capital and users who don't care much about daily price swings.

What's Driving the Growth

Stellar's decentralized exchange volume runs about $713,000 daily, showing solid liquidity and trading depth. The network's stablecoin market cap exceeds $244 million, positioning it as a go-to for global remittances and stable transfers. Developers are getting excited about the upcoming Soroban smart contracts, which offer a cheaper, faster alternative to Ethereum and Solana. Meanwhile, new DeFi apps are offering staking and liquidity rewards that lock more XLM into protocols and push TVL higher.

This isn't speculation-driven growth—it's actual usage.

A 50% price drop looks terrible at first glance, but rising TVL during a price decline often signals something important: strong user confidence and genuine utility growth. The fundamentals are strengthening even as the market doesn't care yet.

We've seen this pattern before with Ethereum, Avalanche, and Solana, where TVL expansion preceded the next major price run. For Stellar, this could be the quiet buildup phase before markets catch on to what's actually happening on the network.

The key question is whether Stellar can keep this momentum going. Success with Soroban smart contracts, continued DeFi integrations, and potential partnerships with fintech and payment companies could accelerate things further. If these trends hold, Stellar might evolve from a niche payments network into a full DeFi ecosystem with stable liquidity, institutional-grade settlements, and steady user growth.

Usman Salis

Usman Salis

Usman Salis

Usman Salis