Solana's about to make a move that could change everything. The network is gearing up for what might be its biggest upgrade ever – something called Alpenglow that could make transactions lightning-fast and put SOL in direct competition with giants like Nasdaq.

Here's the thing: Solana's already crushing it with 35 million daily transactions, beating out major stock exchanges left and right. But this Alpenglow upgrade? It's designed to take things to a whole new level, potentially cutting transaction times from over 12 seconds down to just 100-150 milliseconds. That's seriously fast.

What Makes This SOL Upgrade So Special?

The Alpenglow proposal is getting ready for a community vote between Epochs 840 and 420. If it gets the two-thirds majority it needs, we're looking at a complete overhaul of how Solana processes transactions.

Right now, Solana uses something called proof-of-history with TowerBFT consensus. It works, but it's got some issues – mainly those annoying 12.8-second confirmation times that can slow things down when the network gets busy. The developers behind Alpenglow spotted these problems and came up with Votor, a much sleeker voting system that can finalize blocks in just one or two rounds.

But here's what's really exciting: this isn't just about making things a bit faster. We're talking about eliminating network congestion by cutting out all that unnecessary gossip messaging that clogs up the system. For SOL holders, this could mean smoother transactions and a network that actually scales properly.

Solana (SOL) Already Outperforms Major Stock Exchanges

Here's something that'll blow your mind: Solana just hit 35 million transactions recently, which is more than most major stock exchanges handle in a day. We're talking about beating the Tokyo Stock Exchange (5 million daily), India's NSE (3 million), Hong Kong Exchange (2.5 million), and pretty much every other major trading hub out there.

This isn't just impressive on paper – it shows that SOL's network can actually handle real-world trading volume that rivals traditional finance. When you think about Solana price predictions, this kind of throughput suggests the network is ready for serious institutional adoption.

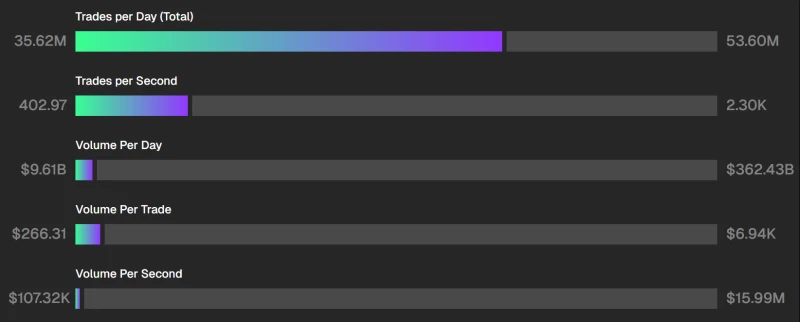

The big target now? Nasdaq. Sure, there's still a gap – Nasdaq does 2,290 trades per second versus Solana's 402, and handles $362.43 billion daily compared to SOL's $9.61 billion. But with Alpenglow potentially bringing those lightning-fast 100-150 millisecond finality times, Solana could seriously challenge traditional exchanges where speed matters most.

Market watchers think the combination of this upgrade and growing adoption could give Solana a real shot at competing with established financial infrastructure. For anyone keeping an eye on SOL price predictions, this represents a huge opportunity if the network can pull it off.

Usman Salis

Usman Salis

Usman Salis

Usman Salis