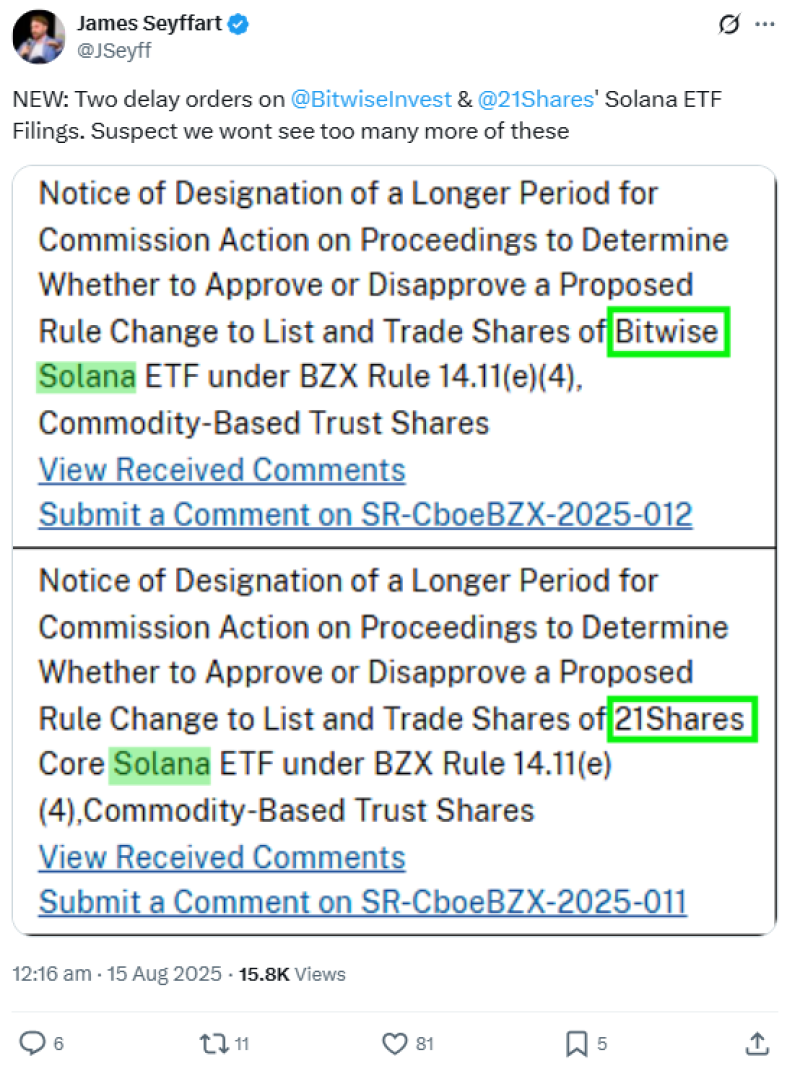

The Solana (SOL) ETF saga took another turn this week when the SEC decided it wasn't quite ready to pull the trigger. On August 14, regulators announced they're extending their review of ETF applications from Bitwise, 21Shares, and Canary Capital by another 60 days.

This isn't exactly shocking news – the SEC has been playing this same game with crypto ETFs for months. They've done the same dance with XRP and other altcoin proposals, always asking for "more time to review." What's different this time? They've maxed out their delay options. October 16, 2025 is the hard deadline – no more extensions allowed.

Why SOL ETF Approval Odds Are Still Sky-High

Here's where things get interesting. Despite the delay, Bloomberg's top ETF guys – James Seyffart and Eric Balchunas – are still incredibly bullish. They've bumped their approval odds up to 95%, which is basically as confident as you can get without guaranteeing anything.

Seyffart isn't sweating the delay at all. He's saying the October deadline is still totally doable, and here's why he's so confident: the SEC has been talking. A lot. When regulators go radio silent, that's usually a bad sign. But when they're asking for amendments and having back-and-forth conversations with applicants, it means they're actually trying to make things work.

The recent wave of application tweaks and modifications tells a story. It's not the SEC saying "no thanks" – it's them saying "let's figure this out together."

The Solana (SOL) ETF Gold Rush Is Real

While these three companies deal with delays, the competition is heating up big time. We're talking about some serious players jumping into the Solana ETF race: VanEck (crypto ETF veterans), Grayscale (the trust conversion kings), plus CoinShares, Franklin Templeton, and Fidelity.

The newest player? Invesco Galaxy just threw their hat in the ring too. When you see this many heavyweight asset managers chasing the same opportunity, it tells you something – they all smell money.

This competition could be great news for regular investors. When multiple ETFs launch at once, companies usually try to undercut each other on fees. Translation: cheaper access to SOL for everyone.

Usman Salis

Usman Salis

Usman Salis

Usman Salis