Shiba Inu (SHIB) experiences a 17% price surge, bringing hope to investors and sparking discussions on its long-term potential.

Shiba Inu's 18% Price Surge: A Sign of Bullish Momentum?

Shiba Inu (SHIB), the world's second-largest memecoin, has made a remarkable recovery following a sharp decline last week. Over the past 24 hours, SHIB's price has surged by 18%, rekindling investor optimism for a prolonged bull rally. This recent uptick prompts an in-depth look at the factors driving SHIB's resurgence.

Last week, bearish trends pushed SHIB's price down to $0.000013. However, the bulls have made a strong comeback, driving the price up by double digits. According to CoinMarketCap, SHIB's price rose by 18% in the last 24 hours, currently trading at $0.0000166. With a market capitalization exceeding $9 billion, SHIB ranks as the 13th largest cryptocurrency.

Positive Buy/Sell Sentiment for Shiba Inu

The recent price hike has positively influenced SHIB's buy/sell sentiment. Analysis reveals that SHIB's supply outside of exchanges increased, while its supply on exchanges decreased, indicating strong buying pressure. This trend is further supported by a notable increase in exchange outflows.

Interestingly, despite the price surge, whale activity remained relatively flat last week, as evidenced by the stable supply held by top addresses. Additionally, Shiba Inu’s Market Value to Realized Value (MVRV) ratio saw a sharp improvement on July 8, correlating with the recent price increase.

Despite the bullish momentum, not all metrics are favorable for SHIB. Network growth has declined, suggesting fewer new addresses are being used to transfer SHIB tokens. Additionally, the velocity of SHIB has dropped, indicating reduced transaction frequency within a set timeframe.

Will SHIB's Rally Sustain?

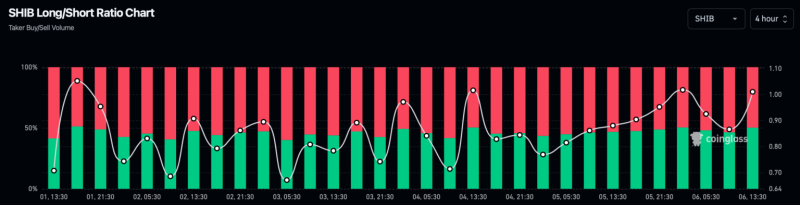

To assess SHIB's future trajectory, AMBCrypto analyzed its derivatives metrics. Data from Coinglass shows a significant uptick in SHIB’s long/short ratio, implying a prevalent bullish sentiment with more long positions than short positions.

Moreover, SHIB's fear and greed index currently stands at 31%, placing the market in a "fear" phase. Historically, this level has often preceded price hikes. Technical indicators also support a bullish outlook: the MACD suggests a potential bullish crossover, and the Relative Strength Index (RSI) has exited the oversold zone, both signaling possible continued upward movement.

In conclusion, as Shiba Inu navigates through market dynamics, its recent 18% price surge has sparked renewed optimism among investors. Despite certain challenges, the overall sentiment remains bullish, backed by positive technical indicators and a strong buy/sell sentiment. As the market watches closely, SHIB's next moves will be crucial in determining its long-term prospects in the cryptocurrency landscape.

Peter Smith

Peter Smith

Peter Smith

Peter Smith