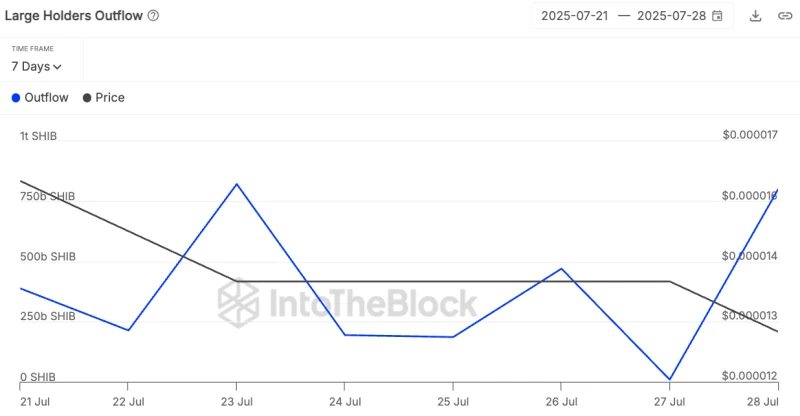

Something wild happened with Shiba Inu yesterday, but you wouldn't know it from looking at the price. While SHIB stayed stuck between $0.000014 and $0.000013, whale activity went absolutely nuts behind the scenes.

Here's what went down: on July 27, large holders were moving around just 9.27 billion SHIB tokens – pretty normal stuff. But then July 28 hit, and boom – that number shot up to 798.22 billion SHIB. That's an insane 8,866% jump in whale movement, all happening in 24 hours.

Now, before you start thinking "oh no, the whales are dumping," let's talk about who these "whales" actually are. IntoTheBlock defines large holders as wallets with more than 0.1% of SHIB's total supply. Sure, that includes some big institutional players, but mostly we're talking about exchanges like Coinbase, Binance, Robinhood, and Upbit.

These exchanges hold tens of trillions of SHIB tokens – basically a huge chunk of everything that's out there. So when we see massive outflows, it's probably not whales panic-selling. It's more likely regular people pulling their coins off exchanges.

Shiba Inu (SHIB) Holders Moving Off Exchanges

And honestly? That's actually pretty bullish. When people move their crypto off exchanges, they're usually doing it for good reasons. Maybe they want to stake it, throw it in cold storage, or use it in some DeFi play. Whatever the case, taking tokens off exchanges usually means people are feeling confident and planning to hold long-term.

The timing here is interesting too. This whole surge came after about a week of basically nothing happening with SHIB. It's like everyone suddenly woke up and decided to make their move at once.

What's really weird is that with all this massive movement – we're talking nearly 800 billion tokens here – SHIB's price just... didn't care. Normally you'd expect some kind of reaction when that much crypto starts moving around, but the market acted like nothing happened.

Shiba Inu (SHIB) Price Action Lagging Behind

But here's the thing – these kinds of big structural changes often happen right before things get volatile. It's like everything's quiet on the surface, but there's all this energy building up underneath.

Think about it: exchanges and big players don't move this much liquidity around for no reason. Whether they're getting ready for a rally or preparing for some major redistribution, something's definitely cooking.

The fact that retail folks are pulling their tokens off exchanges could also mess with supply and demand. Less SHIB sitting on exchange order books means less selling pressure when things do start moving. And if demand picks up while supply gets tighter, that's usually when prices start doing interesting things.

What's Next for Shiba Inu (SHIB) ?

So what does all this mean if you're holding SHIB or thinking about jumping in? Well, you've got this massive spike in whale activity that suggests something's changing, but the price is staying rock solid – which could mean the market's either handling all this really well, or it just hasn't reacted yet.

The optimistic view? All these exchange withdrawals show people are getting more confident about SHIB's future. When folks move their tokens into personal wallets or DeFi protocols, they're basically saying they believe in the project enough to stick around.

The cautious take? This could be prep work for something bigger – either a rally that insiders are positioning for, or some kind of shake-up that's coming down the line.

Either way, SHIB's on-chain data just did something pretty dramatic. Whether that leads to fireworks or just fizzles out, we'll have to wait and see. But one thing's clear – the big players just made their move, and now everyone's watching to see what happens next.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah