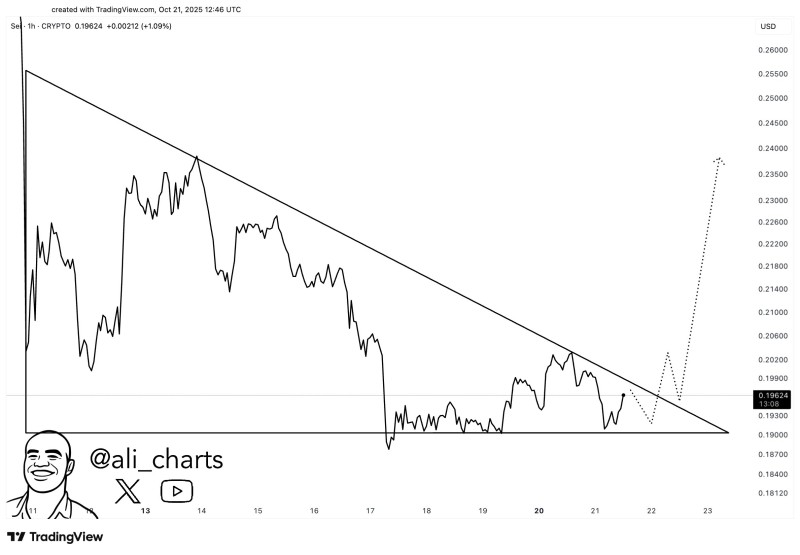

The cryptocurrency SEI is approaching a critical moment after days of consolidation, as the price compresses within a descending triangle pattern. The structure suggests that market volatility is building beneath the surface, with traders closely watching the $0.19 level as a decisive point for the next significant move.

$0.19 Support Level Defines the Current Market Setup

According to crypto analyst Ali, SEI holding $0.19 is key—keep that level, and a move to $0.24 comes into play. The observation aligns with the current technical structure visible on the chart, where SEI continues to respect the lower boundary of the triangle, showing resilience despite downward pressure.

At the time of analysis, SEI trades near $0.196, maintaining its position just above the established support. The chart's descending trendline, stretching from the mid-October highs, acts as a ceiling near $0.20–$0.21, marking the area traders are watching for a possible momentum shift.

Chart Analysis: Pressure Builds Within a Descending Triangle

The chart reveals a sequence of lower highs and consistent lows, forming a tight trading range that often precedes a larger directional move. Volume activity appears subdued, a classic sign of accumulation as market participants prepare for an expansion in volatility. If SEI manages to sustain the $0.19 base and attract stronger buying volume, it could confirm the pattern's upward resolution—potentially targeting $0.24, the next technical resistance zone highlighted on the projection path. Conversely, losing this level could open the way toward $0.18, where the next liquidity support lies.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi