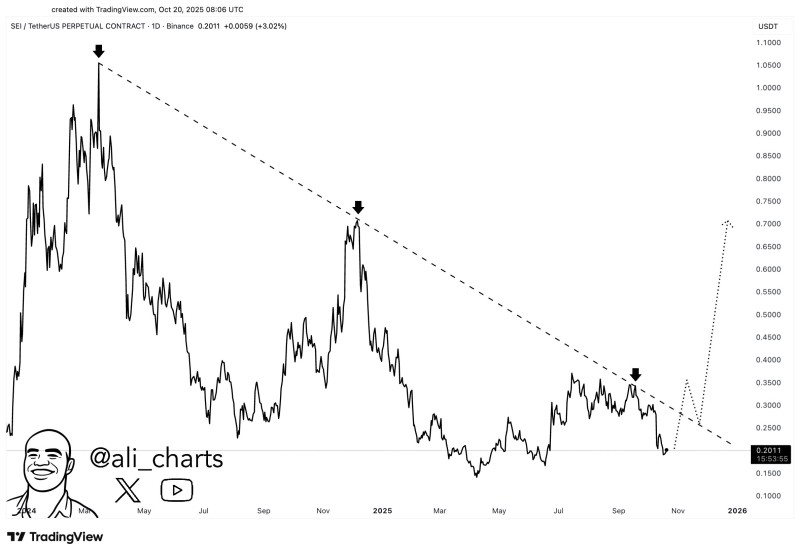

After a year of sustained downward pressure, SEI may finally be approaching a critical turning point that could reshape its technical outlook. The token is testing a descending resistance trendline that has controlled its price trajectory since early 2024, and a breakout above $0.25 could potentially trigger a significant rally.

Key Technical Levels and Breakout Potential

In a recent analysis, crypto strategist Ali noted that if SEI manages to close above $0.25, it could "fly straight to $0.70," marking one of the strongest potential recoveries in the altcoin market. The chart confirms this setup, showing that SEI has been tracing a clear downtrend for over a year, with major rejection points around $1.00 and $0.45. The current structure shows the coin trading around $0.20, resting just below the diagonal resistance that has repeatedly capped its rallies.

A decisive move above $0.25 would invalidate this multi-month pattern and likely trigger a technical breakout, as the next resistance cluster doesn't appear until around $0.65–$0.70. The dotted projection in the chart illustrates this potential upside path, suggesting that once buyers overcome the supply wall, SEI could enter a parabolic move similar to its early 2024 price action.

Market Context and Outlook

From a market perspective, SEI's setup arrives amid renewed optimism in layer-1 blockchain assets and infrastructure coins, many of which have been rebounding as investor sentiment improves. However, if the $0.25 level fails to give way, SEI could continue consolidating between $0.18 and $0.22, extending its long-term compression phase.

Traders should monitor the next few daily closes closely, as this level could determine whether SEI finally reverses its trend or remains locked in a prolonged downcycle. For now, the market's attention is firmly on this critical resistance, with bullish momentum building just below the surface.

Usman Salis

Usman Salis

Usman Salis

Usman Salis