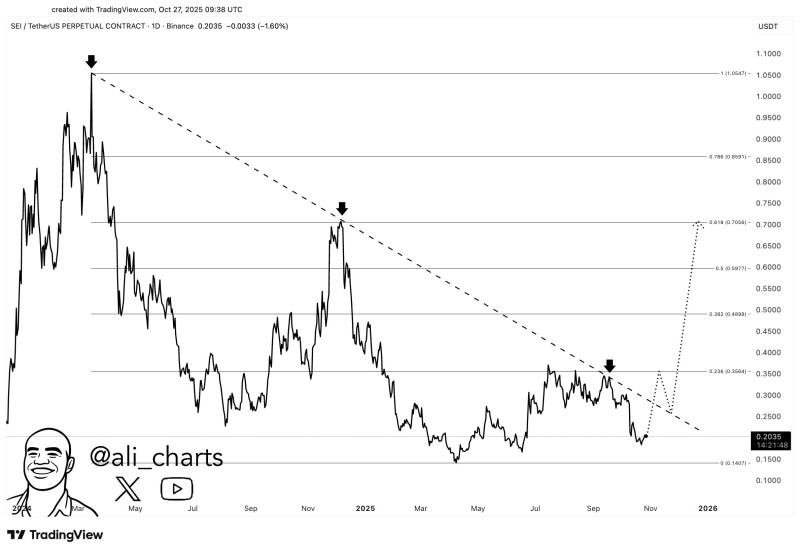

After nearly a year of consolidation, SEI appears ready for a decisive move. The altcoin has traded beneath a descending trendline since early 2024, but recent analysis suggests a breakout above $0.30 could ignite a mid-term rally toward $0.70. This setup is drawing trader attention as the price approaches a pivotal level where bearish pressure could shift to bullish momentum.

Chart Analysis: SEI Compressed Under Descending Resistance

Ali, a respected on-chain analyst, notes the daily SEI chart shows lower highs from the early 2024 peak near $1.05. SEI has followed a pattern of brief rallies and sharp pullbacks, creating a descending channel with rejection points around $0.85, $0.50, and $0.35.

Currently at $0.2035 (–1.6%), the price sits beneath $0.30 resistance where the trendline meets key Fibonacci levels. The setup shows primary resistance at $0.30, support between $0.15–$0.18, and upside targets at $0.36, $0.49, $0.60, and $0.70. A decisive close above $0.30 would confirm a trend reversal, shifting from distribution to accumulation.

Market Context: Accumulation and Shifting Sentiment

While SEI has underperformed layer-1 tokens in 2025, trading activity shows signs of reaccumulation at lower levels. Developers continue expanding the Sei Network with high-speed trading and parallelized execution, which could attract renewed interest.

The altcoin market has turned cautiously optimistic as improving liquidity and Bitcoin stability encourage rotation toward undervalued projects. However, failure to reclaim $0.30 would maintain the downtrend, possibly retesting $0.15 support.

Key Technical Outlook

The $0.30 level defines the trend direction. A confirmed breakout could target $0.60–$0.70, while rejection may push prices toward $0.15–$0.17. Volume expansion above $0.30 would confirm reversal strength.

Peter Smith

Peter Smith

Peter Smith

Peter Smith