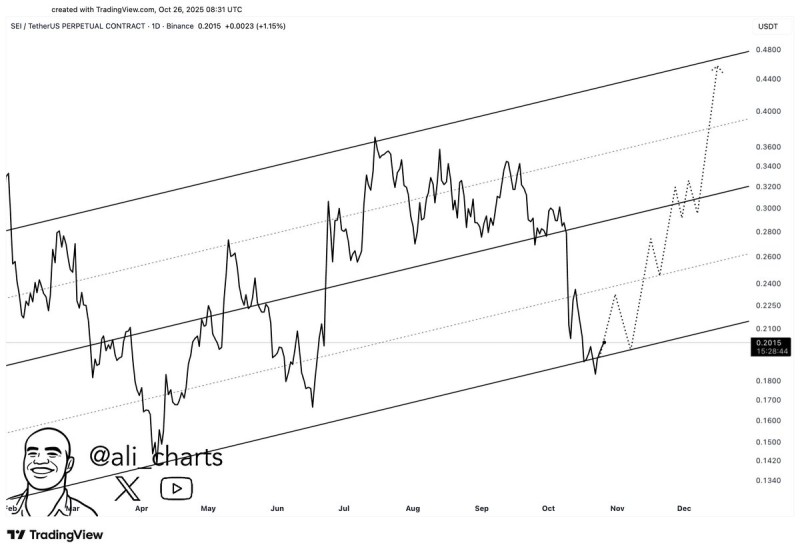

After weeks of choppy trading, SEI has managed to hold above a critical support level, giving traders a reason to stay optimistic. The technical setup suggests the token might be entering a fresh recovery phase within its long-term ascending price channel.

Buyers Step In as SEI Defends Its Base

SEI's key support remains intact, and if buying pressure resumes, the token could target $0.31 and $0.44 — levels that align with mid- and upper-channel resistance on the chart. According to crypto analyst Ali, these targets represent realistic upside scenarios if momentum continues. The daily chart shows SEI trading near $0.2015, just above the lower boundary of an upward channel that's been in play since February.

The lower trendline around $0.19–$0.20 has consistently triggered rebounds, marking it as a major demand area where buyers have shown up repeatedly. Price action has respected this broader rising channel pretty well, with projections indicating a possible rebound path through $0.26, then $0.31, and eventually $0.44. The midline near $0.31 serves as the next resistance, while the upper channel limit around $0.44 represents the long-term bullish target if momentum really picks up. What's interesting is that the projected trajectory suggests a gradual recovery rather than a sudden spike — meaning we're likely to see consolidation phases between each leg higher.

What's Driving the Setup

A few factors seem to be supporting SEI's current technical position:

- Crypto rotation patterns: As Bitcoin consolidates, traders are rotating into smaller-cap assets like SEI, hunting for relative outperformance

- DeFi infrastructure buzz: SEI continues gaining attention for its focus on optimizing decentralized exchange infrastructure, which is attracting speculative interest

- Technical accumulation: The repeated defense of the lower trendline support suggests long-term holders are still accumulating, signaling confidence at these price levels

If buying volume picks up around current levels, these structural factors could help SEI maintain its upward trajectory through the fourth quarter.

Resistance Levels and Risks

Despite the promising setup, there are clear risks to watch. The $0.26–$0.31 range represents a potential resistance zone where previous rallies have stalled out. More importantly, a failure to hold above $0.19 could invalidate the bullish channel structure and expose SEI to deeper pullbacks toward $0.16 or lower. For bulls, maintaining support and reclaiming the channel's midline are the key confirmation signals needed for any sustained move toward $0.44.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir