● Michaël van de Poppe recently highlighted that SEI Coin ($SEI) has hit what he calls a "massive point to accumulate positions." This comes as part of a broader pattern he's observing across several altcoins showing similar accumulation setups.

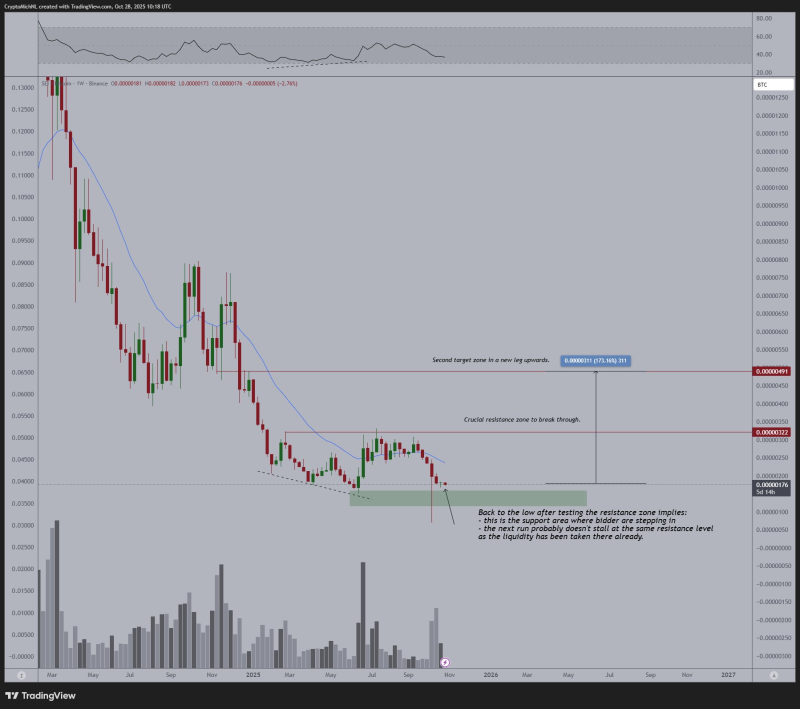

● SEI has dropped back to a major support level on higher timeframes after sweeping liquidity at resistance—a technical pattern that often precedes fresh bullish momentum.

● His chart shows SEI holding around 0.0000176 BTC, the key support zone where "bidders are stepping in," as he puts it. With resistance liquidity already cleared, he believes the odds of getting stuck at the same level again are lower. The first resistance hurdle sits near 0.000032 BTC, with a secondary target around 0.000049 BTC—representing roughly a 170% move.

● Van de Poppe stressed that this setup isn't just technical. "We're firing up a new rally from here, given that there's been a ton of progress on the fundamental side," he noted, pointing to ongoing developments within the SEI ecosystem that could drive stronger performance against Bitcoin.

● Technically, SEI appears to be forming an accumulation phase at long-term support—similar to patterns seen before major reversals in altcoin markets. While the current range looks attractive for longer-term holders, short-term traders should watch for volatility if weekly support breaks.

● In the wider market, SEI's potential bounce fits with growing optimism around Layer-1 projects, many of which are showing early recovery signs after months of correction. If SEI breaks above resistance, it could confirm van de Poppe's outlook and kick off a multi-month rally with potential 100–200% gains versus BTC as part of the next altcoin cycle upswing.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah