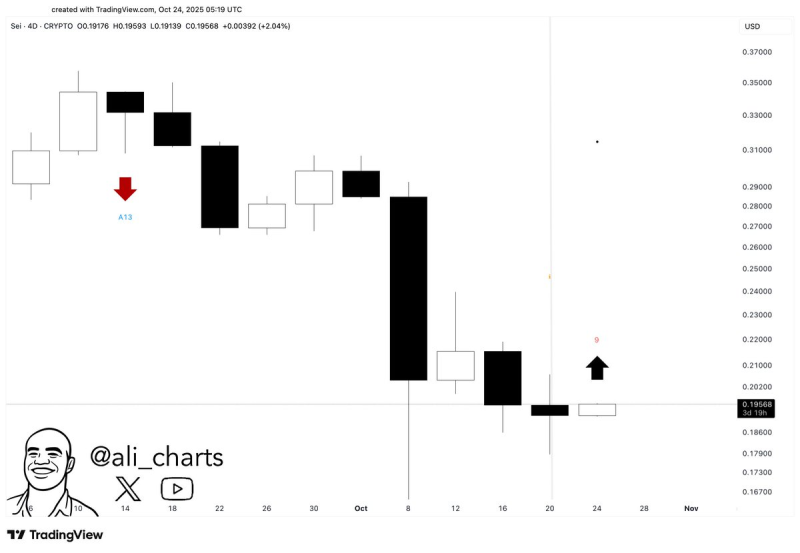

● SEI Coin is showing some interesting technical action. The TD Sequential indicator has printed a buy signal on higher timeframes, which traders usually view as a potential heads-up that a bullish reversal could be brewing. The TradingView chart shared by Ali displays that telltale "9" count candle — basically the indicator's way of saying the current trend might be running out of steam after a lengthy decline.

● Here's the idea: SEI's been taking a beating for a while, but this signal suggests the selling pressure could be losing momentum. The TD Sequential — a tool made famous by market technician Tom DeMark — tends to flash these setups when a shift is coming, especially when they pop up on bigger timeframes like the 4-day chart. That said, this isn't a guaranteed win. Without solid volume backing it up or the broader crypto market showing signs of life, this buy signal could fizzle out, leaving SEI stuck in neutral or heading lower.

● Looking at the numbers, SEI is currently trading around $0.195, barely holding onto a crucial support level at $0.19 after weeks of getting hammered. If this support holds and we see a confirmed bounce, it could pull in short-term buyers and potentially push the price toward the $0.22–$0.25 range — areas that acted as resistance back in early October. On the flip side, if SEI breaks below $0.18, that would pretty much throw cold water on the bullish case and suggest sellers are still running the show.

● Zooming out a bit, what's happening with SEI mirrors a pattern we're seeing across the altcoin space. Coins that got absolutely wrecked in recent months are starting to show early reversal hints. The fact that the TD Sequential is lighting up on multiple timeframes has traders feeling a bit more optimistic that SEI might be finding its bottom. But let's be real — without the whole crypto market cooperating and showing sustained strength, even the prettiest technical setup can fall apart pretty quickly.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah