The crypto world is about to witness something that seemed impossible just a few years ago: spending digital assets as easily as cash at your local coffee shop. What makes this moment even more significant is that it's happening with XRP, a cryptocurrency that has faced its share of regulatory battles and skepticism.

On August 25, 2025, a partnership between some of the biggest names in finance and crypto—Mastercard, Gemini, Ripple, and WebBank—will launch something that could change how we think about digital money forever. With $75 million backing this venture, they're not just testing the waters; they're making a statement that crypto payments are ready for prime time.

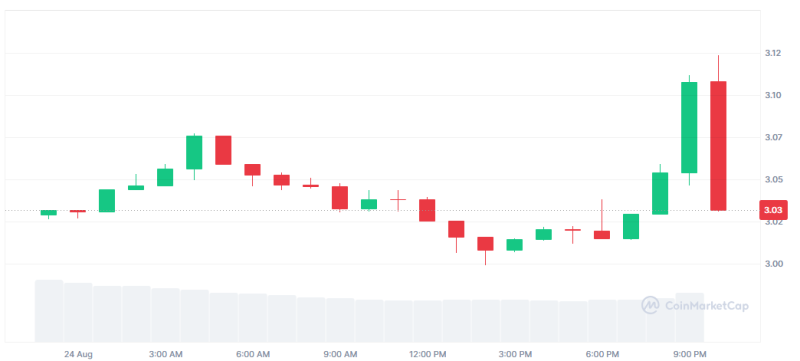

XRP Price in the Spotlight with New Mastercard Collaboration

The timing couldn't be better for XRP holders. Just when the market was looking for the next big catalyst, Mastercard drops this bombshell. We're talking about taking XRP from something you trade on exchanges to something you can actually use to buy groceries.

Crypto trader @WayneTechSPFX isn't the only one excited about this development. The buzz across social media suggests this could be the spark XRP needs to break out of its recent trading range. When you've got Mastercard's global network behind you, that's not just another partnership—that's legitimacy on steroids.

How the XRP Debit Card Will Work

Here's where it gets interesting: you won't need to manually convert your XRP every time you want to buy something. The card handles everything behind the scenes. You tap to pay, and boom—your XRP instantly becomes dollars, euros, or whatever currency the merchant needs.

The beauty is in the simplicity. No complicated crypto wallets at checkout, no awkward explanations to cashiers, no waiting for confirmations. It works exactly like the debit card you're already using, except it's powered by cryptocurrency.

With WebBank handling the banking side and Gemini managing the crypto custody, users get the best of both worlds: traditional banking security with crypto innovation.

XRP Price Outlook After the Announcement

Let's be honest—the crypto market loves a good utility story, and this is utility on steroids. We've seen what happens when cryptocurrencies move beyond speculation into real-world use. Remember when PayPal started accepting Bitcoin? That wasn't just a price bump; it was a paradigm shift.

If people actually start using this XRP card regularly, we're looking at genuine demand rather than just trading hype. More usage means more transactions, more liquidity, and potentially more upward pressure on price.

The $75 million backing isn't just for show either. That's serious money committed to making this work, suggesting the partners expect significant adoption.

Why This Matters for Crypto Adoption

This launch represents something bigger than XRP's price potential—it's proof that crypto can play nice with traditional finance. For years, we've heard about the revolutionary potential of digital currencies, but most people still see them as speculative investments rather than actual money.

A Mastercard-backed crypto debit card changes that narrative completely. It shows that even the most established financial institutions are ready to embrace digital assets when they're packaged correctly.

If this succeeds, expect a flood of similar announcements from other crypto projects. The race to become the next "spendable cryptocurrency" is about to heat up significantly.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah