Grayscale Bitcoin Trust (GBTC) faces significant outflows, totaling $359 million on March 21.

Understanding GBTC's Outflows

Grayscale's Grayscale Bitcoin Trust has recently witnessed a substantial outflow of funds, raising concerns within the cryptocurrency market. On March 21 alone, GBTC recorded an outflow of $359 million, marking a continuation of the trend that has been increasingly noticeable. The question arises: What is driving this mass exodus of funds from one of the leading Bitcoin investment vehicles?

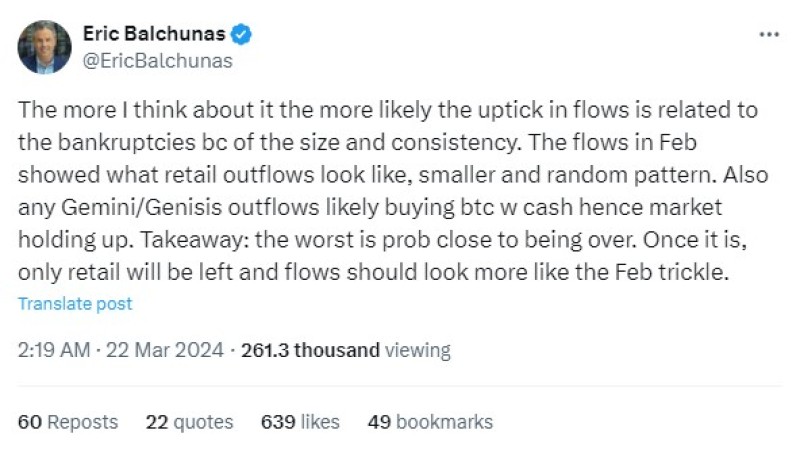

Eric Balchunas' Perspective

ETF analyst Eric Balchunas provides insights into the situation, suggesting that the significant uptick in outflows could be attributed to bankruptcies, owing to their substantial "size and consistency."

Balchunas dismisses the notion that declining Bitcoin prices are solely responsible for retail investors' departure, noting that such outflows would exhibit different characteristics. While retail-driven outflows were indeed observed in February, Balchunas anticipates that the worst may be over, with retail investors unlikely to match the scale of recent outflows alone.

Evaluating Bearish Signals

The diminishing inflows reported by major players like BlackRock and Fidelity are viewed by experts as a potentially bearish sign. Although these inflows are deemed "low" relative to their standards, it's essential to contextualize recent events. Despite the subdued activity from these institutional giants, last week saw "outrageously" high inflows into their ETFs. Additionally, the recent sentiment regarding Bitcoin ETFs, particularly the potential for a net negative, has stirred further concerns about market direction.

The Struggle of Bitcoin's Price Action

Amidst these developments, Bitcoin's price action remains a focal point for market participants. The largest cryptocurrency by market capitalization continues to grapple with establishing a sustainable position above the $66,000 level. This struggle underscores the broader uncertainty prevailing in the cryptocurrency landscape, as investors navigate through shifting market dynamics and institutional sentiments.

The ongoing outflows from Grayscale Bitcoin Trust serve as a reminder of the volatility inherent in the cryptocurrency market. While institutional participation remains a significant factor in shaping market sentiment, retail investors' behavior also warrants close observation. As analysts speculate on the potential implications of recent trends, the outlook for Bitcoin and its associated investment vehicles remains subject to evolving market conditions and investor sentiment.

Conclusion

In conclusion, the recent mass outflow from GBTC underscores the complex interplay of factors influencing cryptocurrency markets. While institutional actions and market sentiment play crucial roles, the resilience of retail investors and the broader adoption of cryptocurrencies also shape the market landscape.

As Bitcoin continues to assert its position as a mainstream asset, navigating through market volatility remains a key challenge for investors and analysts alike.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah