How Much Was the Drop?

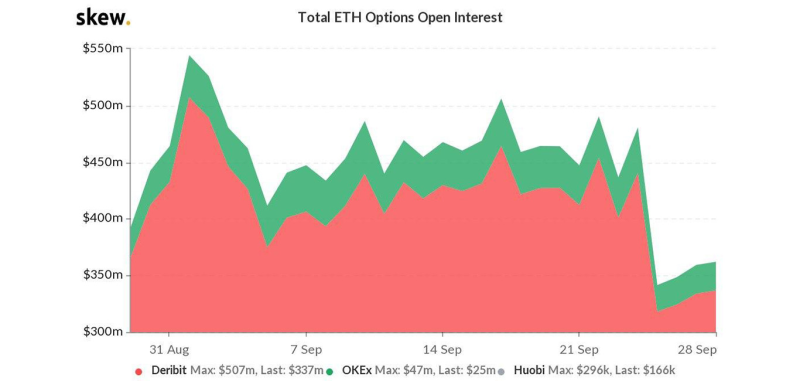

On September 25 a record 458,000 contracts for options in Ethereum expired, which an analyst with Twitter nickname of Joseph Young described as "max pain." Ethereum has raised the price by 8.9% from $337 to $367 in three days. But now the price has declined and it is trading in a sideways range around the $350 mark.

After a massive record-high options expiration last week, Ethereum is stagnating with low volatility.The declining options open interest / volume makes a boring low-volatility range likely in the near term.As options traders call it... max pain? Joseph Young @iamjosephyoung via Twitter

What is the Price of Ethereum and What Are the Reasons for its Recovery?

Ethereum may have come together after the expiry of the options because they alleviated some market risks. Traders normally close or acquire their options contracts before or after expiration. That generates uncertainty, either creating demand for transactions or pressures for sales.

The full expiry of suffering for the price of Ethereum is not inherently barium or bullish. However, it suggests that, before the end, the on-site demand pressure from ETH choice buyers may have been placed on the sales side.

Ethereum will face two $373 and $390 zones of technical resistance shortly. Some traders appear to be carefully positive as ETH displayed stability in excess of $330.

The number of regular transactions on Ethereum has hit an all-time high according to the data from Etherscan. It exceeded thresholds as ETH prices hit a record high in January of 2018. The data suggest that the decentralized finance sector (DeFi) is a big source of demand and operation for apps.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov