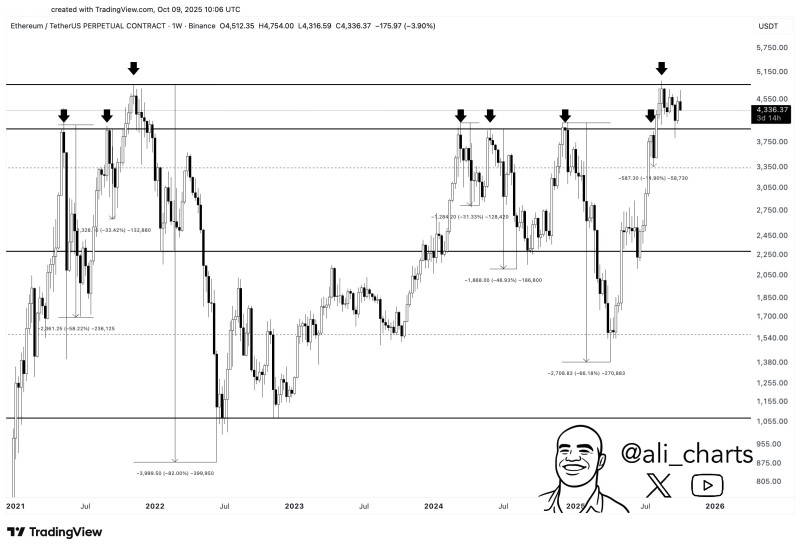

Ethereum (ETH) has returned to what traders call its "danger zone" - a price corridor between $4,000 and $4,800 that's historically blocked bullish momentum. With ETH hovering around $4,336, the market confronts a critical question: will buyers finally break through, or are we headed for another rejection?

Chart Analysis: A History of Failed Breakouts

Crypto analyst Ali notes that the $4,000–$4,800 band marks a key turning point for Ethereum. The chart tells a clear story of repeated failures in this region, with each rejection leading to declines of 30% to over 60%.

The support at $4,000 is crucial - losing it could push prices toward $3,750 or even $3,350. Meanwhile, $4,800 remains the ceiling ETH hasn't managed to breach since 2021. Breaking above that level could open the door to $5,150 and beyond.

Why This Matters Now

This test comes at an interesting time. Ethereum's Layer-2 ecosystem is growing fast, the broader crypto market is showing strength alongside Bitcoin, and long-term holders increasingly view ETH as both a tech investment and potential store of value. The stakes feel higher than previous attempts.

What's Next

If bulls can hold above $4,000 and push through $4,800, we could see a rally toward $5,500. But another rejection here might send ETH tumbling back toward $3,350 or lower - possibly even $2,750 if support breaks down entirely.

Peter Smith

Peter Smith

Peter Smith

Peter Smith