Ethereum (ETH) biggest investors are on the move again. Recent data reveals a substantial reshuffling among Ethereum whales — wallets holding between 10,000 and 100,000 ETH. Over 230,000 ETH (roughly $950 million) were transferred in just one week, a pattern often seen before periods of increased volatility or profit-taking after market rallies.

This activity lines up with Ethereum's price hovering near $4,100, suggesting major holders may be adjusting their positions as the asset consolidates following its recent climb.

Whale Movements: What the Numbers Show

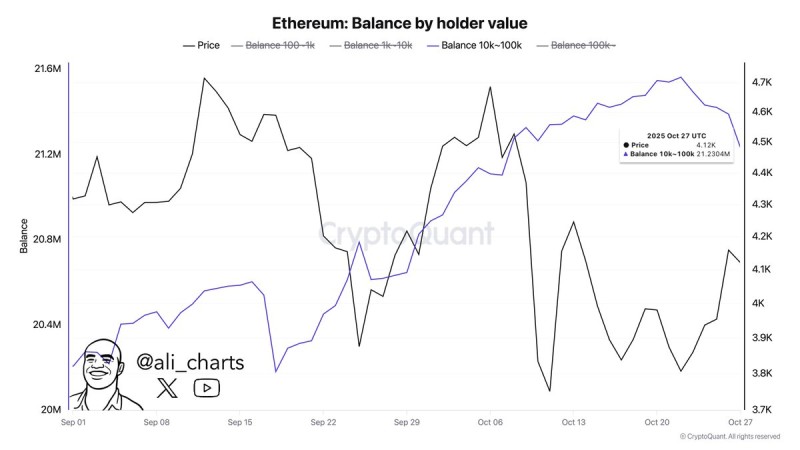

A chart shared by analyst Ali, based on CryptoQuant data, tracks two key metrics: Ethereum's price and the total balance held by whale addresses. From early September through late October 2025, whale balances climbed steadily before dropping from 21.6 million ETH to 21.23 million ETH. This roughly 230,000 ETH reduction represents one of the largest short-term outflows from this group in recent months.

The timing is notable. These transfers happened just as Ethereum struggled to hold above $4,600, hinting at possible profit-taking or strategic repositioning before broader market shifts. History shows similar movements have often preceded short-term corrections or changes in accumulation patterns.

Reading Between the Lines

The drop in whale balances likely points to several possibilities: exchange inflows as large holders prepare for potential sales, portfolio adjustments as institutional players diversify or hedge against volatility, or reallocation toward staking contracts as yields shift across DeFi platforms. While smaller holders have stayed relatively stable, large accounts continue to drive the market's liquidity behavior, making their moves critical for near-term price action.

Market Backdrop: Where Ethereum Stands

This whale activity unfolds against a mixed market landscape. Ethereum is consolidating in the $4,000–$4,200 range after a strong rally earlier this quarter. Short-term price swings have widened, suggesting large transfers could amplify market reactions. Despite these fluctuations, fundamentals remain solid with strong network activity, DeFi engagement, and staking participation providing long-term support.

This redistribution phase reflects a broader pattern of smart money positioning ahead of potential market shifts, whether toward renewed accumulation or a temporary cooling period.

What Comes Next

The coming weeks will hinge on whether Ethereum holds support above the psychologically important $4,000 level, whether on-chain data confirms exchange inflows (bearish signal) or staking inflows (bullish signal), and whether whale accumulation or distribution trends continue. If large holders start accumulating again, it could signal renewed confidence and price stability. Persistent outflows, however, may indicate caution among institutions ahead of macroeconomic catalysts.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov