Ethereum (ETH) is experiencing significant selling pressure after major holders offloaded 90,000 ETH within just 48 hours. This massive dump by whale wallets has traders questioning market sentiment and wondering if ETH can maintain its position near recent highs. The sudden move comes at a crucial time when the cryptocurrency was attempting to break through key resistance levels.

Whale Activity Sparks Market Concerns

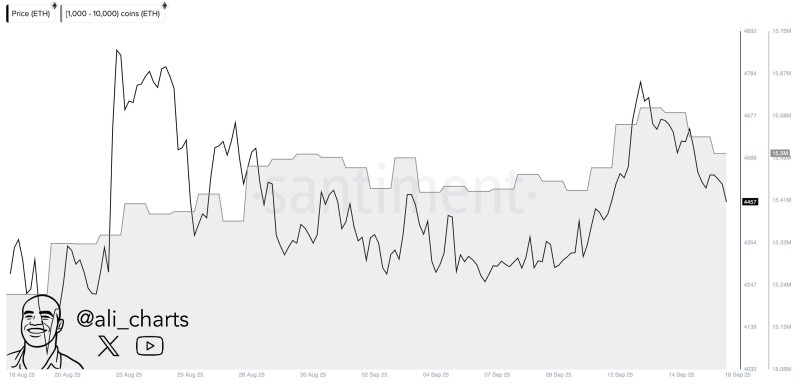

Recent data shows how wallets containing between 1,000 and 10,000 ETH dramatically reduced their holdings, signaling either profit-taking or strategic positioning before expected volatility.

As trader Ali highlighted, this pattern is particularly concerning given its timing.

The data reveals a concerning pattern where whale sell-offs coincided with weakening price momentum, often a precursor to broader market corrections. When these large holders start moving their assets, it typically indicates shifting market dynamics that smaller investors should pay attention to.

Current Price Action and Technical Levels

Ethereum is currently trading around $4,457, struggling to maintain momentum after failing to break above the $4,700 resistance zone. Technical analysis shows strong resistance between $4,700 and $4,800, while immediate support sits near $4,350. If whale selling continues, ETH could easily test these lower support levels, with potential liquidity gaps that might accelerate any downward movement.

Understanding the Whale Sell-Off

Several factors likely contributed to this massive liquidation. Profit-taking appears obvious given Ethereum's recent rally, but macroeconomic uncertainty also plays a role as markets await Federal Reserve policy updates. Many whales are probably repositioning their portfolios, redistributing risk across different assets rather than maintaining heavy ETH exposure. This behavior often reflects reduced confidence in short-term price appreciation, even when long-term fundamentals remain strong.

What This Means for Traders

The 90,000 ETH sell-off within 48 hours serves as a clear warning signal for traders and investors. While Ethereum continues showing underlying strength, heavy whale activity typically precedes increased volatility periods. Market participants should closely monitor key support levels, as continued selling pressure from large holders could determine ETH's next significant price direction. The coming days will be crucial in determining whether this was simply profit-taking or the beginning of a larger correction.

Peter Smith

Peter Smith

Peter Smith

Peter Smith