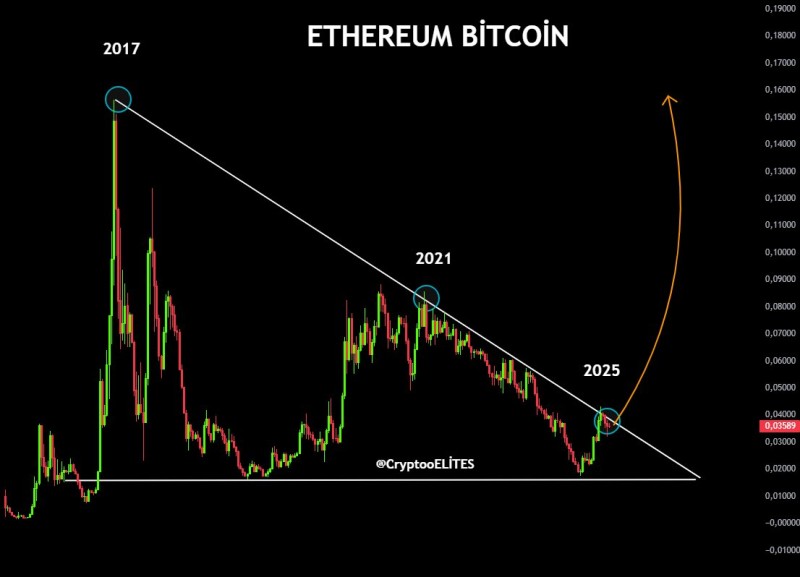

Ethereum is testing a critical resistance level against Bitcoin that hasn't been challenged since 2021. The ETH/BTC chart shows a long-term trendline that, when broken in the past, has sparked major altcoin rallies. With Ethereum approaching this same threshold in 2025, analysts are watching closely for signs of a repeat performance.

The Technical Setup

According to CryptooELITES, Ethereum's ratio against Bitcoin is pressing against a descending resistance line that dates back to 2017. This isn't just any resistance — it's the same line that marked major turning points in both 2017 and 2021. Each time ETH broke above it, a powerful rally followed. Currently trading around 0.036 BTC, Ethereum is once again testing this barrier. If it breaks through and holds, the target range could be 0.08–0.10 BTC, levels last seen during the 2021 bull market.

The ETH/BTC chart matters because it often signals broader market shifts. When Ethereum outperforms Bitcoin, it typically means investors are rotating capital into altcoins and taking on more risk. The current pattern suggests we might be at the edge of that kind of shift.

What's Supporting This Move

Several factors beyond the chart support the case for Ethereum's strength: growing Layer-2 adoption and DeFi activity, anticipated institutional flows through ETFs, and the typical post-halving cycle where altcoins begin to shine 6–12 months after Bitcoin's halving event. We're right in that window now.

If history is any guide, a confirmed breakout could kick off the next altseason — a sustained period where Ethereum and major altcoins outperform Bitcoin. Every previous break of this trendline has coincided with massive altcoin rallies. The same setup is forming again, which is why 2025–2026 might be pivotal for Ethereum and the wider crypto market.

Usman Salis

Usman Salis

Usman Salis

Usman Salis