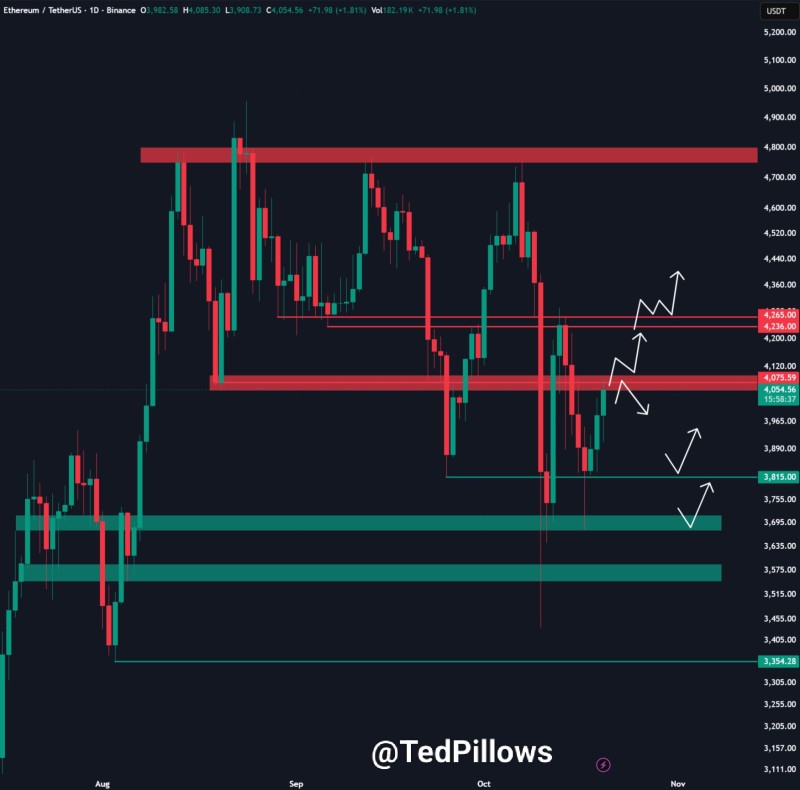

Ethereum's price has reached a critical turning point. After bouncing from $3,800 support, ETH is now retesting the $4,100 resistance level that has shaped the recent downtrend.

Key Levels Defining the Battle

Trader Ted points out that this zone will decide whether Ethereum has found a local bottom or will continue sliding lower. The market is gearing up for a move that could define November's trading range.

ETH is currently trapped between two important zones: resistance sits between $4,075–$4,265, while support holds at $3,815, with deeper backing at $3,350–$3,575. After recovering from the $3,800 demand zone, Ethereum is now knocking on the $4,100 door—a level that's been flipping between support and resistance since late August. A clean daily close above this threshold would flip the short-term structure from bearish to bullish.

If Ethereum pushes through and holds $4,100, it would signal that buyers are back in control and establish a higher low pattern. From there, ETH could target $4,265, with the next major hurdle around $4,800—the top of the current range. This would also likely boost confidence across the altcoin market, since Ethereum typically leads during recovery phases. On the flip side, if ETH gets rejected at $4,100, another leg down becomes likely. That could send the price back to $3,815, or even down to the $3,575–$3,350 zone where the next accumulation area waits. Such a move would reinforce the downtrend that started after ETH peaked near $4,800 in early September.

Market Context and Sentiment

This $4,100 test comes while the broader market stays cautious. Bitcoin's sideways action near resistance has kept altcoins like ETH in limbo. Still, long-term interest in Ethereum remains supported by ETF developments and network upgrades, even as short-term volatility continues. Traders are watching closely to see if Ethereum can reclaim momentum or face another correction.

The chart is crystal clear—$4,100 is where bulls and bears are fighting it out. A confirmed breakout could kick off a new uptrend toward $4,265 and possibly $4,800. But if this level rejects the price, expect another drop toward $3,815 or lower, extending the correction. The next few days will tell the story.

Usman Salis

Usman Salis

Usman Salis

Usman Salis