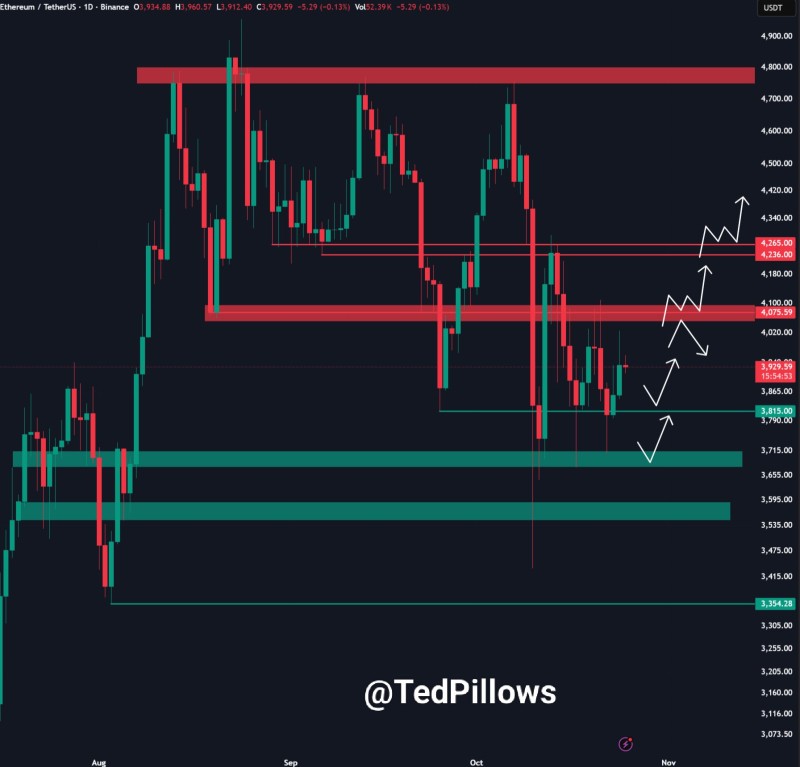

Ethereum has hit a wall. After several failed attempts to push past $4,000, ETH is now consolidating around $3,900, caught between resistance and support.

Trading in a Tight Box

Analysis from Ted suggests a possible pullback to $3,800—a move that could shake out weak hands before the next breakout attempt. The question now is whether buyers can defend that level and regain momentum.

ETH is currently hovering near $3,930, locked in a well-defined range. Resistance sits between $4,075 and $4,265, repeatedly pushing price back down. Support has held firm around $3,790–$3,865, catching every dip so far. The chart shows this clearly—red zones mark where bulls keep getting rejected, while green zones mark where buyers step in.

This setup suggests price compression, where volatility squeezes before something breaks. A quick retest of $3,800 could be the liquidity grab needed before ETH makes its next real run. The white arrows on the chart map out two paths: either a brief dip into support followed by a bounce, or a gradual grind higher if buyers hold current levels.

Key Levels That Matter

Watching $3,790–$3,865 is critical—this zone has absorbed selling pressure multiple times in recent weeks. If it breaks, the next meaningful support is around $3,715–$3,600. On the upside, bulls need to reclaim $4,100–$4,265 to flip sentiment. A clean break above $4,300 would open the door to $4,500 and beyond.

Ethereum isn't alone in this slowdown. Bitcoin's range-bound trading near $67,000 has dampened altcoin momentum, and the broader market is waiting on macro news—particularly upcoming inflation data and Fed commentary. Despite the stall, Ethereum's fundamentals remain solid. Layer 2 solutions continue expanding, staking participation is rising, and on-chain activity on rollups like Arbitrum and Optimism keeps growing. But for now, traders are playing it safe, waiting for a clear signal before committing to either direction.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets