⬤ A Latin American crypto exchange just revealed numbers that show how blockchain payments are actually being used at scale. Bitso processed a staggering $82 billion in stablecoin payments throughout 2025, marking the biggest year yet for digital settlement infrastructure in the region. The company relies on XRP and RLUSD as the backbone for moving money between US senders and recipients across Latin American countries.

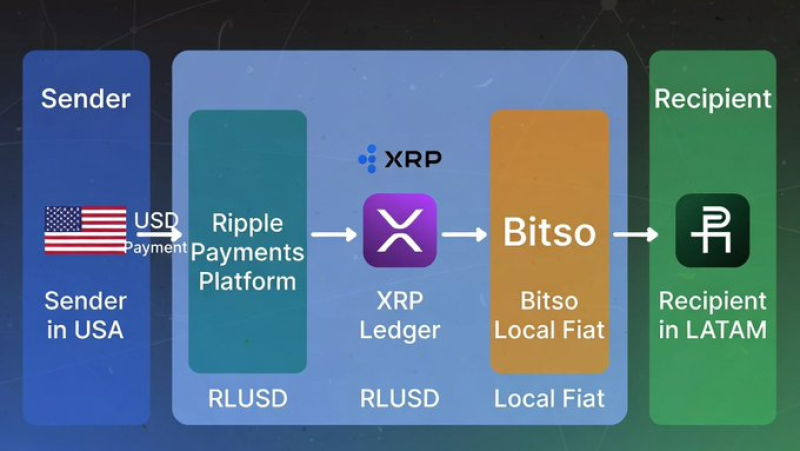

⬤ Most of this volume flows through Bitso Business, the platform's institutional arm that now serves over 1,900 corporate clients. Here's how it works: dollars come in from the US, get converted through Ripple's payment network, settle via the XRP Ledger, then convert to local currency at the receiving end. It's the kind of infrastructure detailed in blockchain payment corridor expansion.

⬤ The $82 billion figure isn't just impressive—it's evidence that crypto rails are handling real payment volume at institutional scale. XRP acts as the bridge that makes these transfers possible, while RLUSD provides stability during the settlement process. This mirrors broader trends seen in stablecoin based remittance growth.

⬤ What stands out is how quietly this infrastructure has grown. While crypto headlines focus on price movements, companies like Bitso have been building actual payment networks that move billions. The numbers suggest businesses are finding blockchain settlements faster and cheaper than traditional wire transfers, especially for the US-to-LATAM corridor where banking fees have historically been steep.

⬤ The takeaway: blockchain payment infrastructure isn't coming—it's already here, processing tens of billions in real transactions across emerging markets.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi