⬤ Basler AG has completely overhauled its revenue expectations for 2025 multiple times this year. The German computer vision specialist initially forecast conservative growth of just 4.5%, then doubled down with a 14% revision, before landing on its current 21% projection. The dramatic shifts reveal how quickly sentiment can change in industrial technology markets.

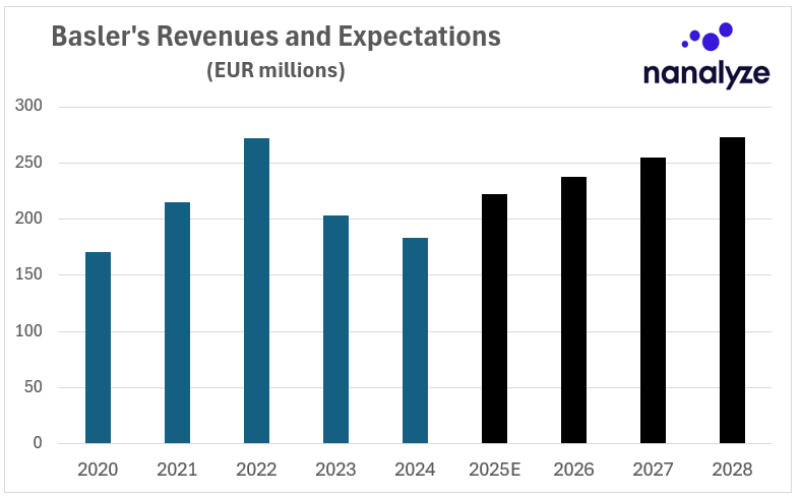

⬤ The company's recent financial trajectory has been anything but smooth. Basler's revenue climbed from around €170 million in 2020 to peak near €270 million in 2022, before tumbling to approximately €200 million in 2023 and further dropping to €180 million in 2024. Now management expects a strong rebound to roughly €220 million in 2025, with growth continuing through 2028. This recovery pattern mirrors broader trends explored in industrial automation demand recovery.

⬤ These frequent guidance upgrades tell two different stories simultaneously. On one hand, they signal genuinely strengthening demand for machine vision products. On the other, they expose how limited management's visibility really was when making initial projections. As one analyst noted, "rapid upward adjustments suggest management expectations changed significantly during the year rather than gradually improving."

⬤ The situation perfectly captures the forecasting challenges facing cyclical tech companies. When demand conditions shift during industrial recovery phases, even experienced management teams struggle to predict quarterly revenue accurately. Similar forecasting volatility has plagued other sectors, as detailed in cyclical tech revenue forecasting challenges.

⬤ What does this mean for investors? While the upgraded guidance points to genuine improvement in Basler's core markets, the path of revisions itself is a reminder that companies tied to industrial and machine vision sectors can experience sharp expectation swings. The 21% growth target represents a meaningful recovery, but the journey to get there shows just how unpredictable cyclical technology markets remain during demand transitions.

Usman Salis

Usman Salis

Usman Salis

Usman Salis