⬤ Hungary's inflation crept up to 3.3% year-over-year in December, breaching the country's 3% target. According to analyst Steve Hanke, this uptick coincided with faster-than-ideal monetary expansion. Hungary's M3 money supply is currently growing at 7.5% annually, outpacing Hanke's Golden Growth Rate of 6.9%—the threshold believed to maintain the 3% inflation objective.

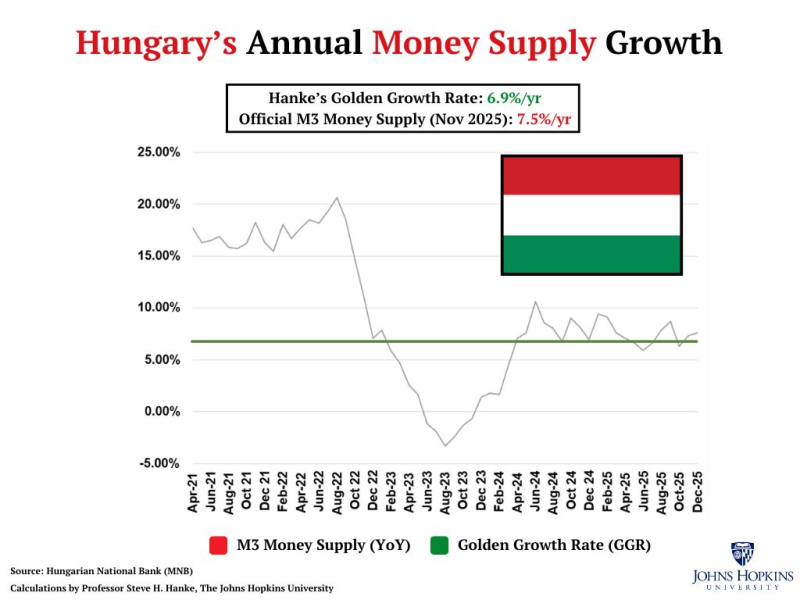

⬤ A chart comparing Hungary's actual money supply vs Golden Growth Rate shows M3 growth bouncing back sharply after a 2023 contraction. The data reveals M3 expanding at 7.5% per year versus the 6.9% benchmark, suggesting monetary conditions are running hotter than inflation targets can absorb.

⬤ The 0.6 percentage point gap between actual M3 growth and the Golden Rate essentially explains why inflation and money supply in 2026 remain misaligned with the central bank's goals. When money creation outpaces the economy's productive capacity, prices tend to follow upward.

⬤ The relationship is straightforward: excess monetary growth fuels inflation. Unlike some European neighbors where M3 returns to optimal growth, Hungary's money supply remains above the sweet spot for price stability. This monetary overshoot directly translates into the 0.3 percentage point inflation gap above target.

⬤ The key takeaway? Hungary's inflation problem isn't mysterious—it's mathematical. With M3 running 0.6 points above the Golden Growth Rate, inflation sits 0.3 points above target. Until monetary expansion slows to match the benchmark, price pressures will likely persist above the central bank's comfort zone.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi