⬤ Meta Platforms just hit a major monetization milestone. The company's global average revenue per user climbed to $57.03, marking a new record. But the real story is in the regional breakdown—users in the U.S. and Canada are now worth $78.37 each, roughly eleven times what the company makes from users elsewhere in the world.

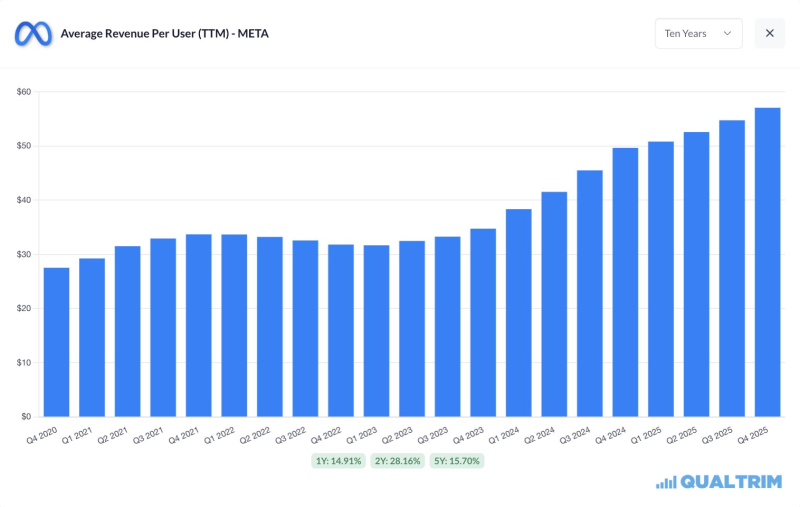

⬤ The numbers tell a clear growth story. Back in 2020, Meta user monetization growth hovered in the high $20s. By 2021 and early 2022, it pushed above $30, then plateaued through 2022 and into early 2023. Since then, it's been climbing steadily, breaking through previous ceilings in 2024 and continuing into 2025.

⬤ According to the latest data, Meta's record average revenue per user reflects not just user growth, but more effective monetization strategies across its platforms. The company has consistently found new ways to extract value from each user, even as growth in certain markets slows.

⬤ The regional revenue gap in tech platforms continues to widen. North America remains Meta's cash cow, generating far more per user than Europe, Asia-Pacific, or the rest of world markets combined. While the global average keeps rising, the disparity between what a North American user is worth versus users elsewhere has never been more obvious.

⬤ This data matters because ARPU has become one of the key metrics investors watch when evaluating social media platforms. It's not just about how many people use Facebook, Instagram, or WhatsApp—it's about how much money Meta can make from each of them. And right now, that number keeps going up, especially in North America where advertising budgets remain strong and user engagement stays high.

⬤ The trend suggests Meta has found a sustainable path for revenue growth even if user additions slow down. By squeezing more value from existing users through better ad targeting, premium features, and expanded commerce tools, the company keeps pushing ARPU higher quarter after quarter.

Usman Salis

Usman Salis

Usman Salis

Usman Salis