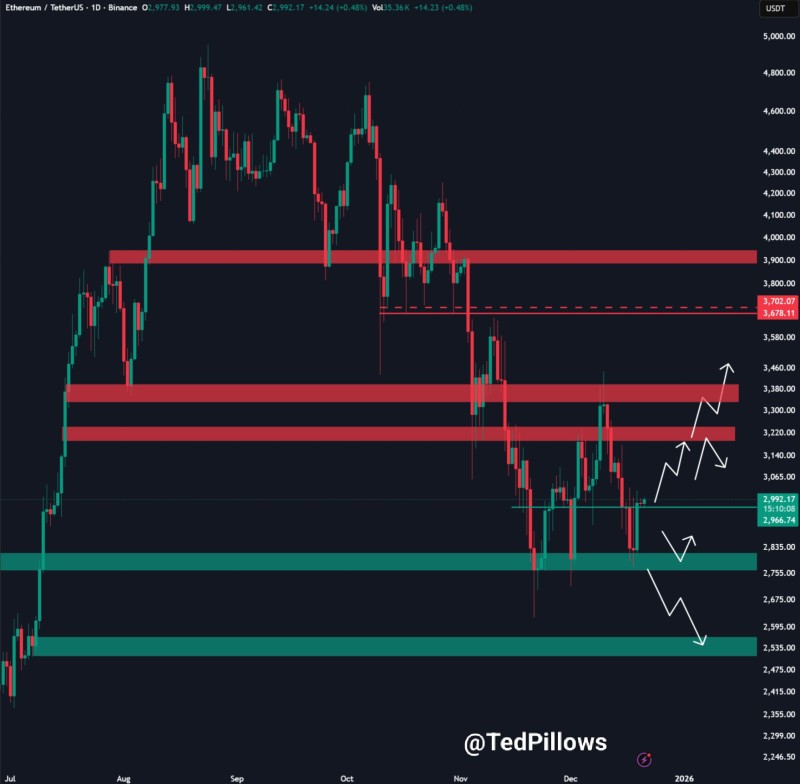

⬤ Ethereum has entered a consolidation phase after recent volatility, with the daily chart showing price trading below the $3,000 mark. The market is stuck in a clearly defined range, fluctuating between overhead resistance and lower demand zones. Price is compressing, and traders are waiting to see which direction it breaks.

⬤ On the upside, there's strong resistance just below and around $3,000, marked by repeated rejections. This area lines up with previous distribution levels where sellers have consistently stepped in. A daily close above $3,000 would be needed to shift the short-term structure and confirm strength beyond this range. Until that happens, upside attempts remain unconfirmed.

⬤ On the downside, Ethereum continues to hold a demand area between roughly $2,700 and $2,800. This zone has absorbed selling pressure during recent declines and triggered short-term rebounds. If price can't reclaim higher resistance, a retest of this lower support band is a realistic scenario based on current structure.

⬤ This setup matters even more with quarterly options expiry coming next week—a period that often brings increased volatility in crypto markets. Range-bound price action near major technical levels can amplify moves once derivatives positions roll off. How Ethereum resolves this consolidation, either breaking above $3,000 or dropping back toward lower demand, could influence near-term sentiment and price direction across the broader crypto space.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi