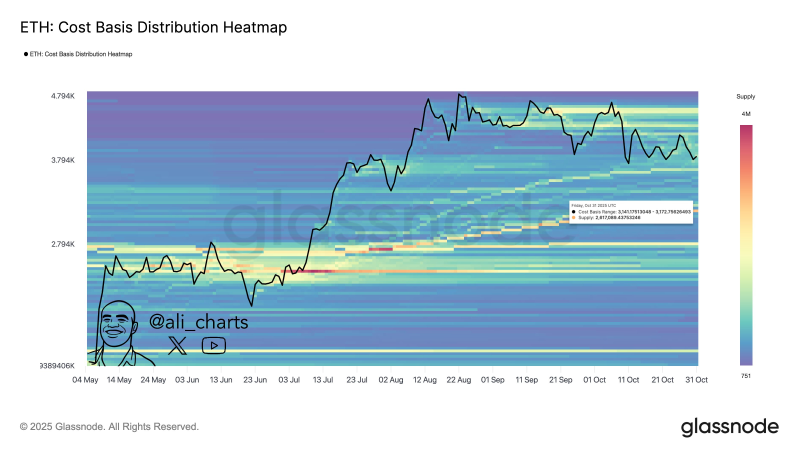

● According to Ali, Ethereum has established a critical demand zone at $3,120, where roughly 2.62 million ETH have been accumulated based on Glassnode data. The cost-basis heatmap reveals heavy concentration between $3,117 and $3,172, making this one of ETH's most significant support levels in recent months.

● This accumulation pattern suggests whales and long-term investors see this price range as an attractive entry point. Typically, these large on-chain clusters act as price floors that cushion against downside moves. If Ethereum holds above this level, we could see momentum build toward the $3,800–$4,000 resistance zone.

● The support level aligns with positive fundamentals: growing Layer-2 adoption, rising staking participation, and increased institutional interest following ETF developments. These trends continue strengthening Ethereum's position as the top smart contract platform.

● That said, a break below $3,100 could trigger a pullback toward $2,900 as traders take profits. Still, the broader outlook remains bullish, with long-term holders staying confident despite market swings.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi