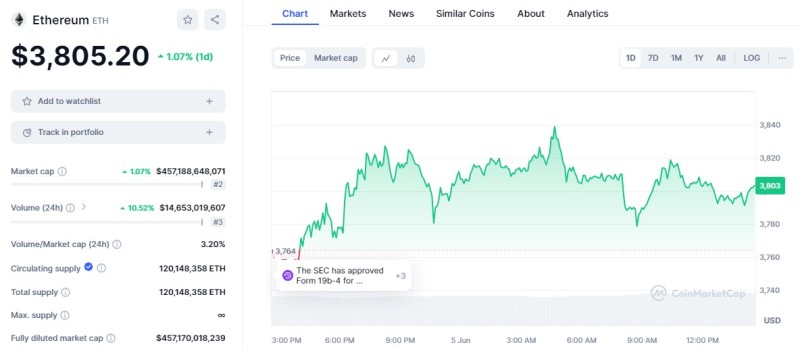

Ethereum witnessed a staggering $3 billion withdrawal from centralized exchanges following the approval of Ether ETFs in the United States, signaling a potential supply shortage in the crypto market.

Crypto: The Exodus of Ethereum from CEX

Following the recent approval of Ether ETFs in the United States on May 23, over $3 billion worth of Ethereum has been swiftly withdrawn from centralized exchange platforms, hinting at a looming scarcity in the crypto market.

Between May 23 and June 2, approximately 797,000 Ethers, valued at $3.02 billion, were drained from centralized exchange reserves, significantly reducing available liquidity for immediate sales and further tightening the circulating supply of Ether.

Ethereum's Shrinking Exchange Supply

The latest data from Glassnode reveals a stark decline in the percentage of Ether's total supply held on exchange platforms, plummeting to a historic low of 10.6%, setting the stage for potential price surges.

The diminishing reserves of Ethereum could intensify buying pressure in Ether markets, setting the stage for significant speculative bullish movements, particularly as the launch of Ether ETFs approaches, potentially as soon as the end of June.

Echoes of Bitcoin's ETF Surge

Experts draw parallels to Bitcoin's surge following the initiation of BTC ETF negotiations in January, projecting a similar scenario of explosive growth for Ethereum in the wake of ETF approval.

With regulated ETFs on the horizon and dwindling exchange supplies, Ethereum stands poised to reach new heights in the near future, presenting a lucrative opportunity for investors alongside the risk of a speculative bubble if unchecked euphoria takes hold.

Usman Salis

Usman Salis

Usman Salis

Usman Salis