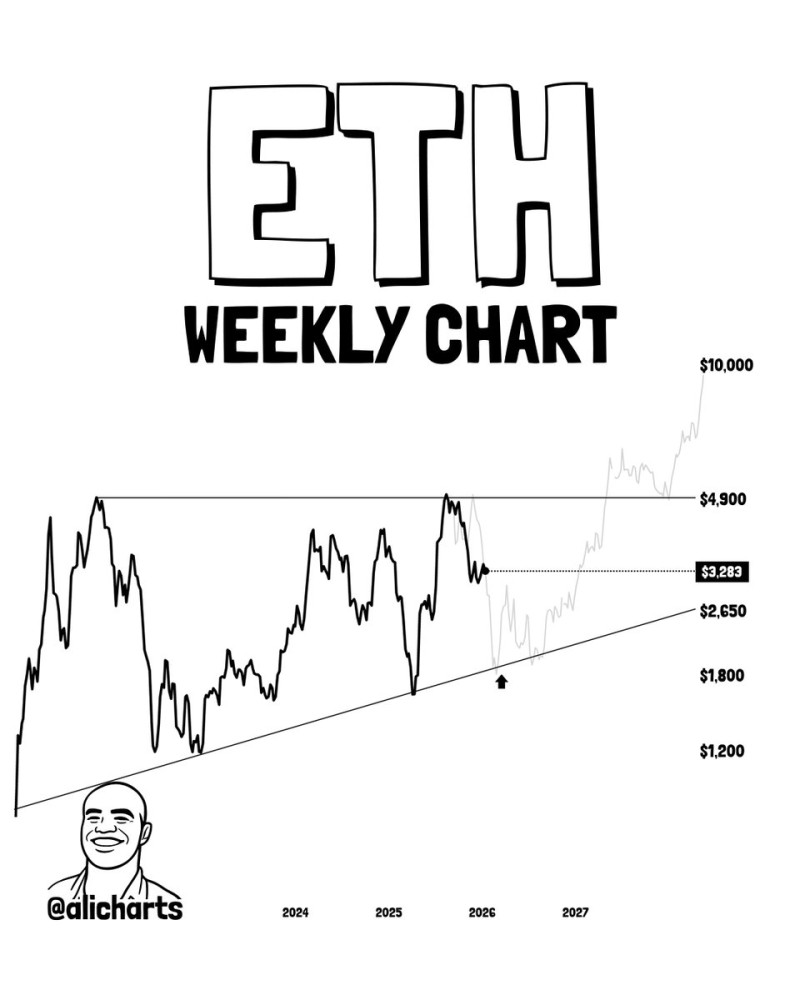

⬤ Ethereum's weekly chart reveals a long-term price framework focused on structural support and upside potential rather than near-term volatility. The ETH roadmap emphasizes accumulation near $1,800 with a longer-term target around $10,000, placing recent action within a multi-year cycle context.

⬤ The chart shows ETH trading above rising diagonal support that's guided price across several years, originating near $1,200 and continuing as a structural base. Current price sits around $3,283, with $4,900 marking a previous major resistance zone where ETH faced rejection.

⬤ The projection extends into 2026-2027, mapping a potential path toward $10,000 as a continuation of the existing cycle rather than a short-term call. The visualization highlights how ETH has historically respected rising support during extended bull markets.

⬤ This long-term perspective frames Ethereum's behavior within a broader structural story. Key levels at $1,800, $4,900, and $10,000 help contextualize market expectations and potential volatility ahead. How ETH interacts with these zones may shape broader digital asset sentiment and views on cycle sustainability.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi