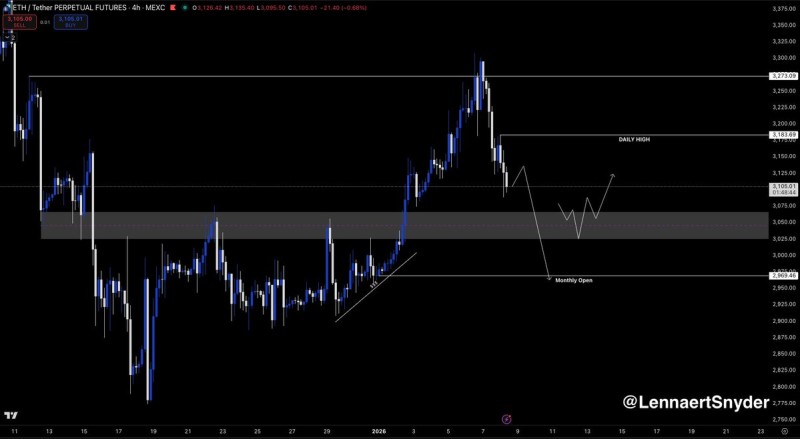

⬤ Ethereum's stuck in a clear downtrend after getting turned away from recent highs, which only added fuel to the bearish momentum on the 4-hour timeframe. ETH swept through liquidity around $3,270 before sellers stepped in hard, proving that higher levels are completely locked down right now. The price failed to hold above resistance and rolled over quickly, keeping the overall bearish pattern firmly in place.

⬤ Right now, traders are watching the weak monthly open near $2,970 as the next major downside target. Ethereum's trading below $3,100, with the daily high around $3,185 acting as the line in the sand for short positions. Stop-losses for existing shorts have been adjusted just above this daily high near $3,190, which makes sense when you're trying to protect capital while staying bearish as long as price can't break above resistance.

⬤ There's also some higher-timeframe support sitting around $3,050, right in what used to be an active demand zone. This area will likely trigger some reaction—maybe even some profit-taking from shorts. But here's the thing: any bounce from that level needs real confirmation through lower-timeframe structure before anyone should consider it meaningful. Without reclaiming higher ground convincingly, any rally from support would just be a correction, not a trend reversal.

⬤ This matters beyond just ETH because Ethereum often sets the tone for broader crypto market sentiment. If price keeps pushing toward that monthly open, it'll confirm the bearish continuation everyone's expecting. Meanwhile, reactions around $3,050 could shake things up short-term with some volatility. For now though, Ethereum looks technically weak, respecting resistance while downside targets remain the primary focus unless key levels get decisively taken back.

Usman Salis

Usman Salis

Usman Salis

Usman Salis