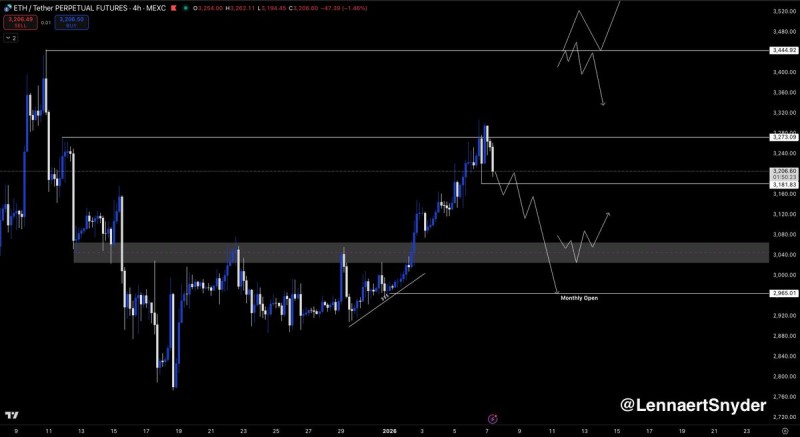

⬤ Ethereum pulled back after spiking above $3,270, grabbing liquidity before reversing course. The token is now hovering around $3,200, and traders are watching to see if it can hold this area or if more downside is coming. The move above $3,270 was brief—just enough to trigger stops and sweep orders before the market turned lower. Now the focus shifts to whether ETH can stabilize or if it's heading for deeper support levels.

⬤ The overall bias stays bearish as long as ETH remains below $3,445, which is the key level that needs to break for any real bullish momentum to return. On the downside, the $2,965 monthly open is acting like a magnet if selling pressure picks up. A drop below $3,180 would confirm the bearish structure and open the door to that monthly level. Right now, ETH is stuck in between—not strong enough to push higher, but not weak enough to collapse yet.

⬤ There's some support sitting around $3,050 where price could catch a bid if the pullback continues. But any bounce from there would need solid confirmation before traders consider it safe to buy. As one analyst noted, "The weak monthly open around $2,965 is highlighted as a downside magnet if price begins to accelerate lower." On the flip side, if ETH reclaims $3,445 and actually holds it, that would flip the script and bring buyers back in. Another fake-out at that level, though, would just reinforce the bearish case.

⬤ These technical levels matter because they're where the real money is positioned—stops, orders, and decision points that drive the next move. If support cracks, it could drag down sentiment across the crypto market, especially if that $2,965 level gets tested. But a clean break above resistance would signal renewed strength and shift the momentum back to the bulls. Until then, ETH is in wait-and-see mode, reacting to liquidity grabs and short-term swings.

Peter Smith

Peter Smith

Peter Smith

Peter Smith