Something big is happening with Ethereum right now. The network that powers everything from DeFi protocols to NFT marketplaces is experiencing a massive surge in activity, with on-chain transaction volume climbing to heights we haven't seen since the legendary 2021 bull market. This isn't just another market blip – it's a signal that could indicate Ethereum is gearing up for its next major run.

The Numbers Don't Lie: Ethereum Is Back in Action

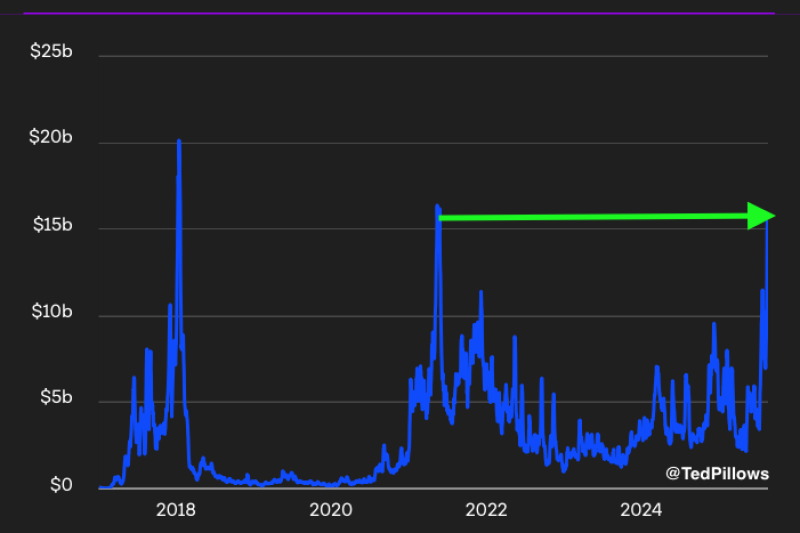

Here's what has crypto analysts buzzing: Ethereum's on-chain volume has surged to nearly $12.9 billion, putting it close to the $16 billion peak recorded in 2021. To put this in perspective, we're talking about the kind of network activity that coincided with ETH's meteoric rise to its all-time high of nearly $5,000.

But this isn't just about nostalgia. Historically, spikes in on-chain volume have coincided with critical turning points, either fueling further breakouts or marking the start of consolidations. The fact that we're seeing this level of activity again suggests that serious money is moving through the Ethereum ecosystem once more.

What's Driving This Resurgence?

The surge in on-chain activity isn't happening in a vacuum. Several factors are converging to create this perfect storm:

Institutional Interest is Back: Strong institutional interest, shrinking supply on exchanges, and growing demand across decentralized finance are all contributing to the renewed activity. When the big players start paying attention to Ethereum again, retail investors typically follow.

DeFi Renaissance: The decentralized finance sector, which essentially runs on Ethereum, is experiencing renewed growth. The network's ongoing dominance in DeFi and cross-chain applications, despite growing competition from newer layer-1 blockchains, shows that Ethereum remains the go-to platform for serious DeFi activity.

Supply Squeeze: Here's where things get really interesting. Exchange balances are shrinking, while OTC reserves dry up, signaling institutional accumulation. When there's less ETH available on exchanges and more being held long-term, it creates upward pressure on price.

The 2021 Parallel That Has Everyone Talking

The comparison to 2021 isn't just about nostalgia – it's about patterns. Ethereum's onchain transaction volume surged to $238 billion in July 2025, reflecting a 70% increase from the previous month and marking the highest monthly total since December 2021. We're seeing the same kind of explosive growth in network usage that preceded Ethereum's last major price surge.

What makes this even more compelling is the context. Bitcoin appears to be entering its final bull phase move, typically a period that determines whether capital begins to rotate heavily into altcoins. Many analysts believe this could mark the beginning of altseason, with Ethereum leading the charge.

What This Means for ETH Price

Currently trading around $4,354.27 USD, Ethereum is already showing impressive strength. ETH trading at $4,425 after reaching a peak of $4,792, just below its all-time high from 2021 demonstrates that the market is taking notice of this increased network activity.

The technical picture looks promising too. The current resistance remains the psychological $4,800–$5,000 zone, which aligns with the 2021 all-time high. A sustained breakout above this level would open the path toward uncharted territory, with analysts pointing to possible targets between $5,500 and $6,000 if momentum continues.

Ethereum Is Building Momentum

Here's the takeaway that matters: Ethereum's network is showing the kind of activity levels that historically precede major price movements. The combination of institutional interest, DeFi growth, supply constraints, and 2021-level on-chain volume creates a compelling case for continued upward momentum.

Of course, crypto markets are notoriously unpredictable, and past performance doesn't guarantee future results. But when you see on-chain metrics that mirror one of the most successful bull runs in crypto history, it's worth paying attention.

The question isn't whether Ethereum will break its all-time high – it's when. And based on the current on-chain activity, that moment might be closer than many people think.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah