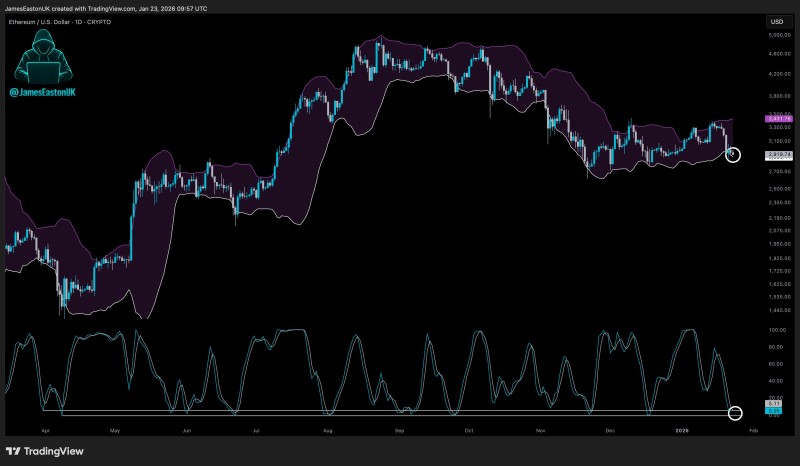

⬤ Ethereum's locked in consolidation mode after dropping from its late-2025 peak above $4,500. Here's the thing—price is now camping out near the lower edge of its volatility range, just under the $3,000 mark, and the selling's actually cooled off. The chart shows ETH compressing into a tighter range, which basically means traders are sitting on their hands waiting to see what happens next.

⬤ What's interesting is how ETH keeps bouncing off that lower volatility band instead of breaking through it. That's telling you the bears don't have enough juice left to push it lower. The whole move down from $4,500+ has been pretty orderly—no panic selling, no crazy volatility spikes. It's been a controlled pullback, which is actually healthier than a sudden crash.

⬤ The momentum indicators are hanging out near their lower ranges too, showing this slow-motion vibe rather than any aggressive trend. We've seen this setup before in previous cycles—markets consolidate like this when they're digesting big moves before picking a direction. The key point? Ethereum's still trading within its broader 2025 structure, so this looks more like a correction than a complete trend flip.

⬤ This matters because ETH tends to set the tone for the wider crypto market. When volatility compresses near these technical levels, it influences how traders position themselves across the board. Whether Ethereum breaks upward or keeps grinding sideways, right now it's all about confirmation. Patience is paying off more than momentum chasing in this environment.

Victoria Bazir

Victoria Bazir

Victoria Bazir

Victoria Bazir