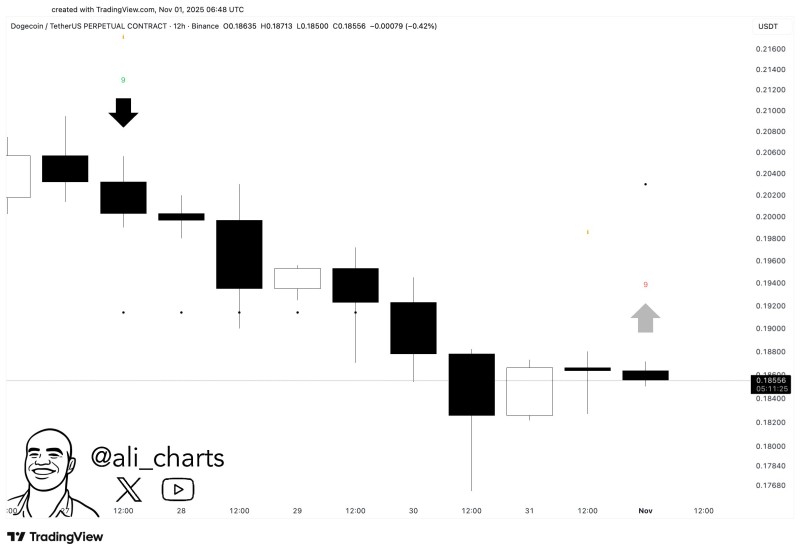

Dogecoin (DOGE) appears poised for a potential short-term rebound following a significant momentum indicator signaling trend exhaustion. A fresh TD Sequential "9" buy signal has emerged on the 12-hour chart—a setup that frequently precedes bullish reversals when validated by subsequent price action. This pattern indicates the recent downtrend may be losing strength, with buyers potentially regaining control near the current support zone around $0.185.

Dogecoin Nears Exhaustion of Selling Pressure

According to analyst Ali, Dogecoin has experienced a modest downtrend over the past week, displaying a series of lower highs and lower lows on the candlestick chart. As of November 1, DOGE trades near $0.186, down 0.42% on Binance.

The critical signal here is the TD Sequential count reaching "9"—historically a robust indicator of potential price reversals. This count marks the end of a bearish cycle, suggesting sellers may soon exhaust their momentum. The chart shows a large downward arrow earlier in the sequence, followed by a smaller upward arrow near the current candle, illustrating the possible transition from bearish to bullish territory.

Technical Levels and Recovery Outlook

Key levels to watch:

- Immediate Support: $0.182–$0.185, where price has found stability after multiple tests

- Short-Term Resistance: $0.194, followed by a stronger ceiling at $0.200

- Pattern Context: Alternating bearish and bullish candles show declining bearish momentum and growing indecision

If DOGE rebounds from its current zone and closes above $0.194, the move could confirm a short-term trend reversal, potentially driving price toward $0.20–$0.21. The mix of red and green candles reflects a classic exhaustion pattern, where neither bulls nor bears dominate decisively.

Market Context and Sentiment

The signal arrives as memecoin volatility has cooled across the broader market, with investors awaiting fresh catalysts. Dogecoin's recent decline followed general crypto weakness, yet on-chain data continues showing strong wallet accumulation near current price levels. Additionally, DOGE remains linked to speculative optimism surrounding potential integrations with X (formerly Twitter)—a narrative supporting long-term interest despite short-term pullbacks.

What Comes Next

While the TD Sequential signal points toward a likely short-term recovery, confirmation depends on whether bulls successfully defend the $0.185 level and push DOGE above $0.194. A decisive close above that range could attract renewed trader interest targeting the $0.20–$0.21 zone. However, if support fails and DOGE drops below $0.182, the setup loses validity, potentially extending the correction toward $0.176. The next 24-48 hours will be critical in determining whether this exhaustion signal translates into meaningful upside momentum.

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi

Eseandre Mordi