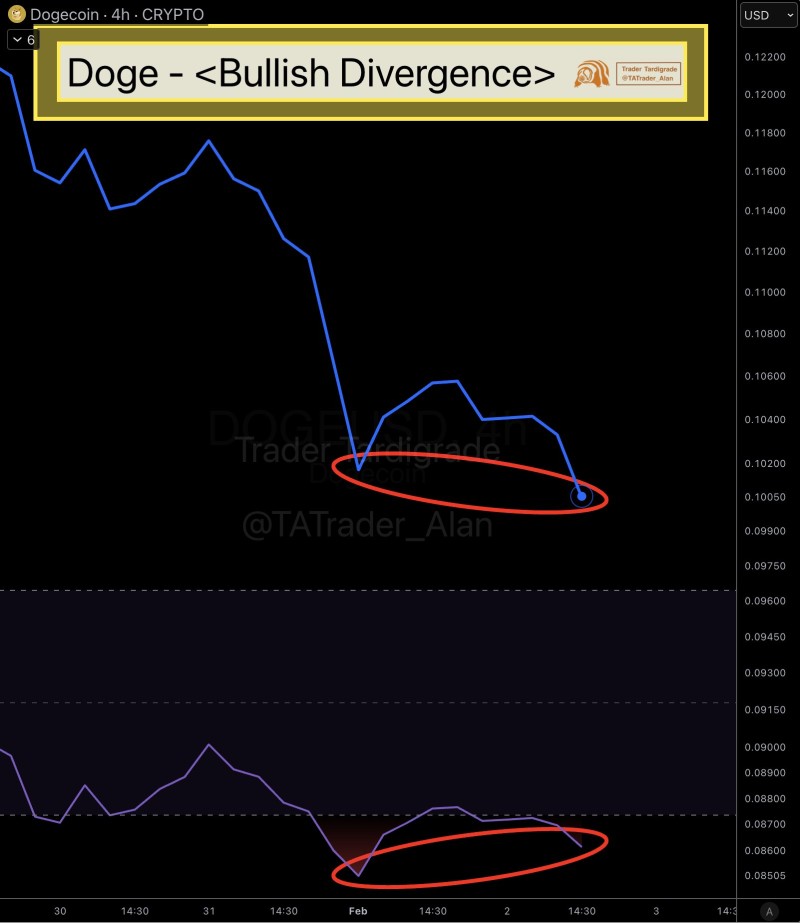

⬤ Dogecoin has been trading under pressure on the four-hour timeframe, with DOGE/USD sliding from recent highs toward the $0.10 area. Price action remains soft, marking a sequence of lower lows as the broader short-term downtrend continues. However, momentum indicators are starting to tell a different story, suggesting selling pressure might be losing steam.

⬤ Dogecoin is displaying a clear bullish divergence on the relative strength index. The chart shows price recording a marginally lower low near the $0.10–$0.102 zone, while the RSI forms a higher low over the same period. This divergence highlights a disconnect between price and momentum, where downside movement isn't being confirmed by RSI anymore. Both the price structure and the momentum signal are visually emphasized on the chart, backing the validity of the divergence.

⬤ The RSI remains in lower territory but is stabilizing rather than accelerating downward. This behavior suggests bearish momentum is fading, even though price hasn't confirmed a reversal yet. The chart doesn't indicate a breakout or trend change at this stage, but bullish divergence often comes before periods of consolidation or short-term rebounds. Current price action reflects hesitation rather than strong continuation selling.

⬤ This signal matters for the crypto market because Dogecoin frequently acts as a proxy for short-term sentiment in speculative assets. A bullish divergence on the four-hour timeframe doesn't guarantee an immediate upside move, but it does highlight a potential transition from aggressive selling toward stabilization. With momentum no longer confirming new price lows, DOGE may be entering a phase of reduced downside pressure. The next directional move will likely depend on whether price can stabilize near current levels or reclaim nearby resistance zones in the coming sessions.

Alex Dudov

Alex Dudov

Alex Dudov

Alex Dudov