⬤ Dogecoin is getting fresh attention after Grayscale launched its Dogecoin Trust ETF, trading under the ticker GDOG. The fund comes with a 0% fee structure and gives investors regulated access to one of crypto's most popular community-driven tokens. The timing looks interesting too—DOGE is currently sitting near a key technical level that's been tested multiple times over the years.

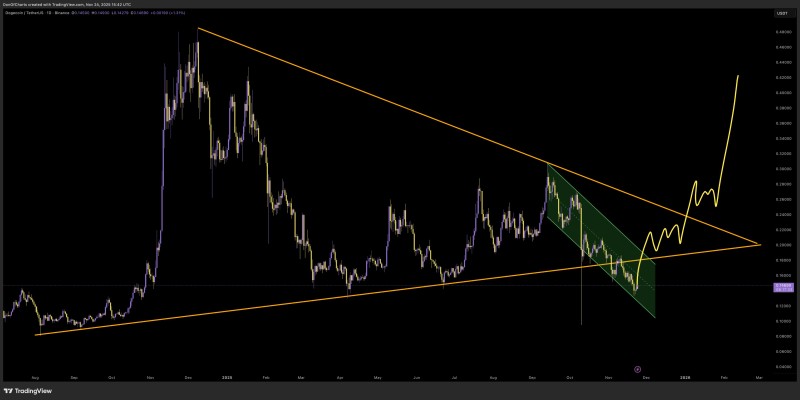

⬤ Looking at the long-term chart, Dogecoin has been trading inside a massive symmetrical pattern that's been building for years. Right now, the price is bouncing near the lower trendline, which has acted as solid support before. There's also a shorter descending channel (marked in green) showing DOGE consolidating downward before trying to find its footing. Traders are watching to see if the price can break above this channel as the first real sign that momentum is shifting back to the upside.

⬤ The chart also maps out a potential scenario where DOGE slowly climbs through the channel and eventually retests the upper boundary of that big triangle pattern. If this plays out, we could see gradual accumulation followed by a breakout attempt, with price targets around $0.20, $0.26, and potentially higher if the momentum really picks up. While the GDOG launch doesn't guarantee any specific price movement, having a zero-fee ETF from a major player like Grayscale definitely adds a positive storyline right when Dogecoin is at a structurally important spot.

⬤ The combination of a brand-new Dogecoin ETF and DOGE testing long-term support creates an interesting setup worth watching. If Dogecoin holds these levels and breaks out of its shorter-term channel, the pattern could shift into something more bullish. Over the next few weeks, we'll see whether the GDOG launch helps bring more attention and interest to Dogecoin during this critical phase.

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets

Artem Voloskovets