Dogecoin is making headlines again as speculation around a potential ETF approval intensifies. Trading at $0.26, the memecoin finds itself at a critical juncture where institutional adoption could dramatically reshape its trajectory. With some analysts eyeing a bold $5 target, the question remains whether ETF-driven institutional flows can transform DOGE from internet meme to serious investment vehicle.

ETF Speculation Drives Institutional Interest

The possibility of a Dogecoin ETF has traders buzzing with excitement. According to market observers like CryptoELlTES, such a product would fundamentally alter the memecoin landscape by introducing institutional capital and legitimacy. Unlike retail-driven price swings, institutional flows tend to be more sustained and substantial, potentially pushing DOGE well beyond its current valuation.

This shift mirrors what happened with Bitcoin when its ETF launched, creating a new class of investors who previously couldn't or wouldn't touch cryptocurrency directly. For Dogecoin, this could mean breaking free from its reputation as purely speculative and entering mainstream financial conversations.

Technical Patterns Point to Potential Breakout

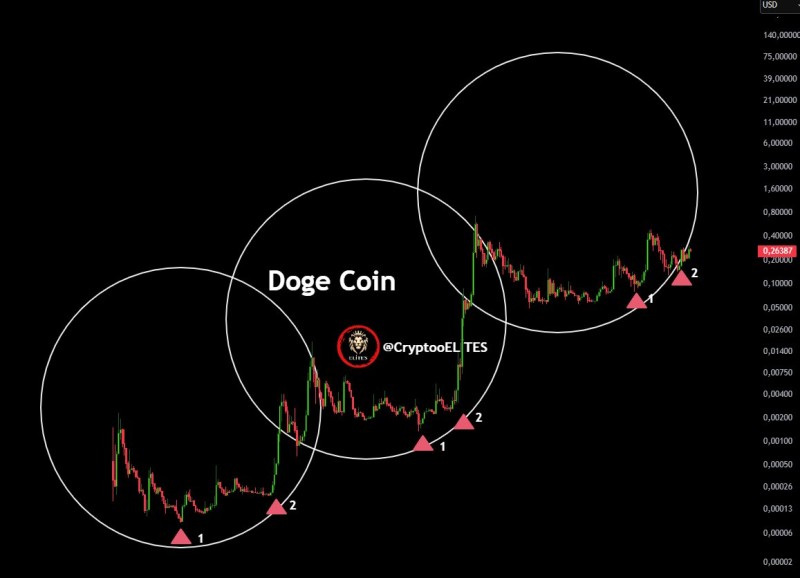

Chart analysis reveals an intriguing cyclical pattern throughout Dogecoin's history. The price typically goes through extended consolidation periods followed by explosive vertical rallies. Currently sitting around $0.26, DOGE appears to be completing another accumulation phase, similar to previous cycles that preceded major breakouts.

Key technical observations:

- DOGE has consistently found support in the $0.20-$0.25 range

- Previous rally cycles show similar consolidation-to-breakout patterns

- Current price action suggests the next major move could be imminent

- ETF approval could serve as the catalyst for breaking out of this range

Broader Market Implications

A Dogecoin ETF would represent more than just another financial product - it would signal mainstream acceptance of memecoins as a legitimate asset class. This development could attract pension funds, hedge funds, and other institutional players who have remained on the sidelines due to regulatory uncertainty or internal policies restricting direct crypto exposure.

Such institutional validation might also trigger a domino effect across other memecoins, though Dogecoin's first-mover advantage and established brand recognition position it uniquely to benefit from this potential shift.

Reality Check on the $5 Target

While $5 per DOGE represents roughly a 20x increase from current levels, it's not entirely far-fetched when considering the combination of factors at play. Historical precedent shows that crypto assets can experience dramatic price appreciation when institutional adoption accelerates, particularly when combined with strong technical setups and community support.

However, traders should approach this target with appropriate caution. The crypto market remains highly volatile, and ETF approval is far from guaranteed. Smart investors will watch for concrete developments rather than trading on speculation alone, while monitoring technical indicators that could confirm or deny the bullish thesis as events unfold.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah