Dogecoin maintains a balanced profit profile with just over half of its circulating supply currently trading above acquisition price, potentially signaling a neutral market sentiment as the popular meme coin rebounds alongside the broader cryptocurrency market.

Dogecoin (DOGE) Supply Profitability Reveals Market Equilibrium

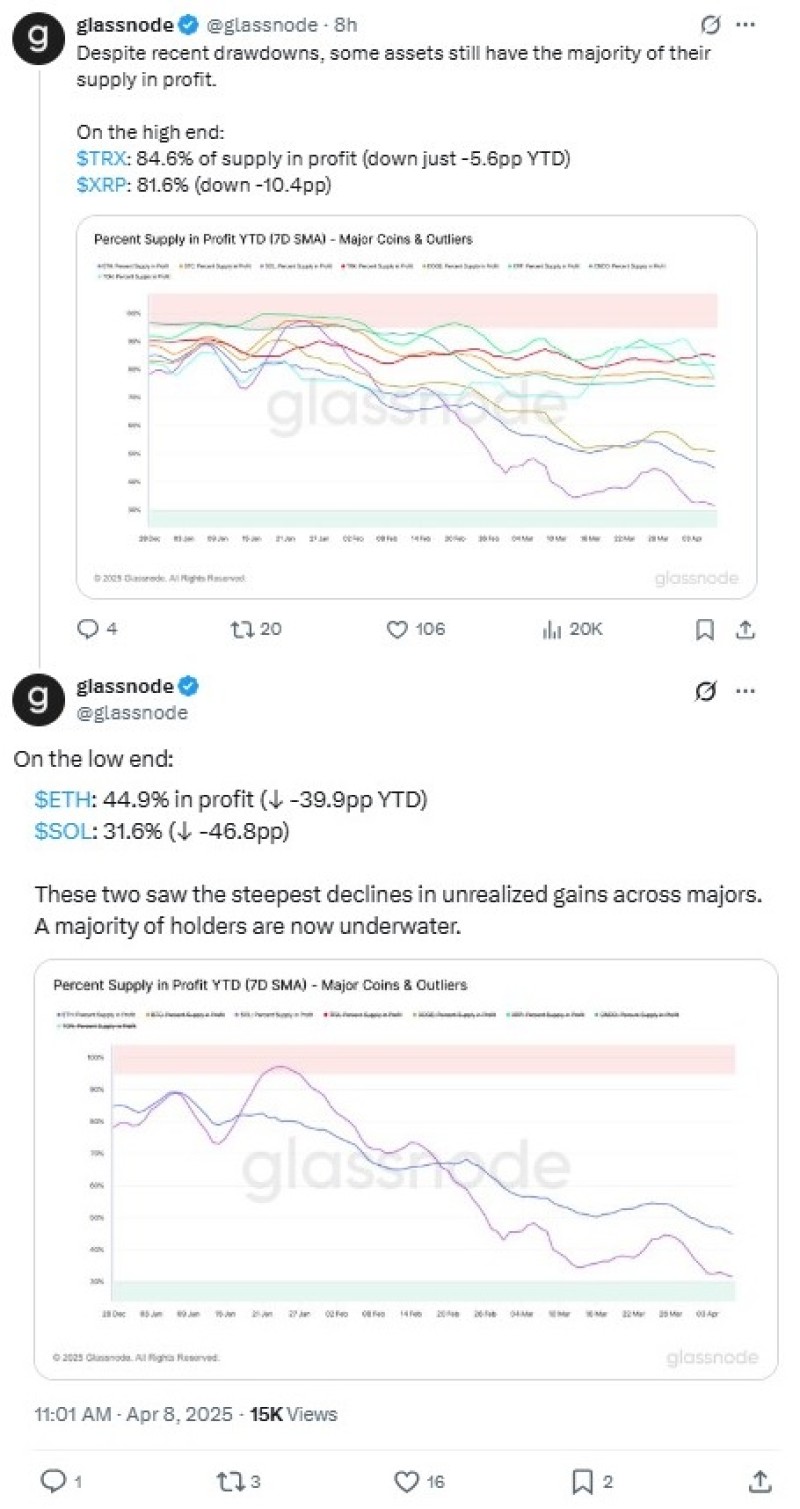

According to recent data from an on-chain analytics platform, Dogecoin currently has 50.8% of its supply in profit, positioning it in the middle range between high-performing and struggling cryptocurrencies. This metric, which measures the percentage of coins whose current price exceeds their last movement price, provides valuable insight into the overall health of the DOGE market.

This balanced profitability figure for DOGE suggests that the investor base is relatively evenly split, with approximately half of holders sitting on gains and the other half experiencing losses at current price levels. Such equilibrium could indicate that DOGE has found a temporary price floor, with selling pressure potentially stabilizing as panic-selling subsides.

DOGE (Dogecoin) Performance Contrasts With Other Major Cryptocurrencies

The on-chain analytics platform's report highlighted significant variation in supply profitability across the cryptocurrency market. Notably, Ethereum and Solana experienced the most severe declines in unrealized profits among major cryptocurrencies, with most holders of these assets currently underwater on their investments.

Dogecoin's middle-ground position, with 50.8% of its supply still profitable, demonstrates relatively stronger resilience compared to these struggling counterparts. This stability could potentially provide DOGE with a more balanced foundation for recovery as market conditions improve.

Dogecoin (DOGE) Price Rebounds Following Market-Wide Recovery

Dogecoin is currently trading near the $0.15 mark, showing signs of recovery after recent market turbulence. At the time of the report, DOGE had increased by 6% over a 24-hour period, reaching approximately $0.154 per token.

This upward movement aligns with a broader cryptocurrency market rebound, led by Bitcoin's recovery to nearly $80,000 after falling below $75,000 late Monday. The recovery triggered positive momentum across major cryptocurrencies, with Dogecoin experiencing gains of up to 13% at one point, helping to offset some of the previous day's significant losses.

DOGE (Dogecoin) Market Dynamics Amid Liquidation Events

Monday's market downturn resulted in massive liquidations across cryptocurrency futures markets, with almost $1.4 billion wiped out as some digital assets experienced price drops exceeding 20%. These liquidation events, while initially painful for leveraged traders, may have set the stage for the subsequent rebound as short positions were liquidated and sellers exhausted their positions.

For Dogecoin specifically, the 50.8% supply in profit metric could prove particularly meaningful in this context. This balanced profit distribution might suggest the reduced likelihood of further panic selling, potentially providing a more stable foundation as the market attempts to find equilibrium following the recent volatility.

The "supply in profit" metric is especially valuable for identifying potential market tops, as a very high percentage of profitable coins could indicate an imminent sell-off when investors decide to take profits. Conversely, Dogecoin's current middle-ground position at 50.8% might represent a more neutral investor sentiment, with relatively balanced incentives to either sell or continue holding.

As the cryptocurrency market navigates this period of uncertainty, Dogecoin's balanced profit profile could potentially provide it with a foundation for stability or even upside momentum if positive catalysts emerge and more investors enter the market. The coming days will likely be crucial in determining whether DOGE can build upon this foundation to regain previous price levels.

Usman Salis

Usman Salis

Usman Salis

Usman Salis