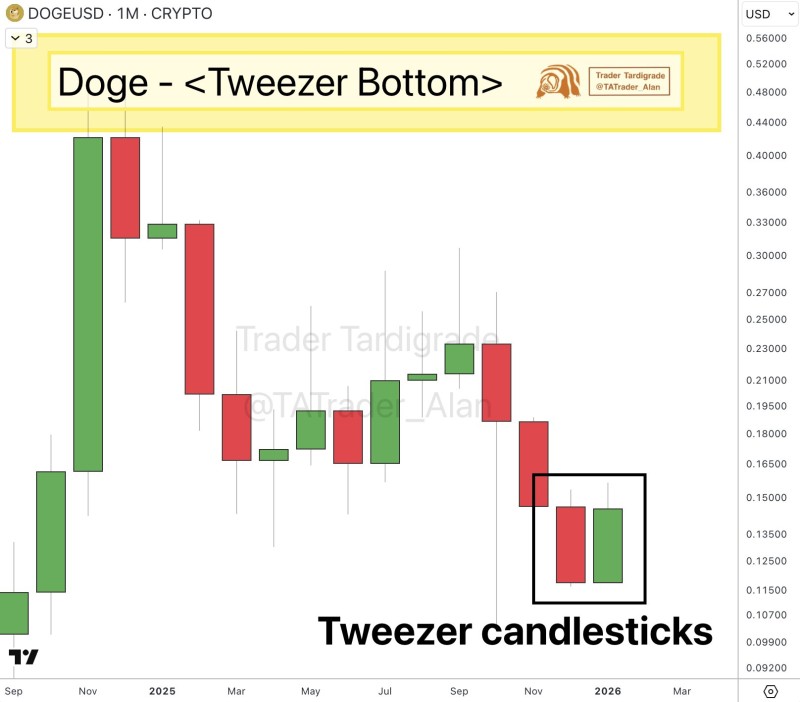

⬤ Dogecoin just printed an important technical signal on its monthly chart that's getting traders excited after a sharp early-month bounce. DOGE/USD has formed a pair of Tweezer candlesticks on the monthly timeframe. This pattern shows up when two consecutive candles share nearly identical lows, typically signaling that selling pressure is running out of steam and a trend reversal might be starting after a decline.

⬤ Here's what makes this interesting: Dogecoin has recovered almost all of last month's losses in just eight days. The Tweezer Bottom is clearly visible around the $0.11–$0.12 zone, where the downside momentum hit a wall and price snapped back quickly. This kind of rapid recovery tells us that buyers didn't just trickle in gradually—they stepped up decisively. The price structure shows real stabilization after a correction, with demand showing up at a well-defined support level.

⬤ Monthly candlestick patterns carry serious weight because they reflect longer-term market sentiment better than daily or weekly signals. A Tweezer Bottom appearing on the monthly chart suggests a genuine shift in market structure, especially after a weak period. The fact that DOGE erased nearly a full month's decline in just over a week shows improving sentiment and renewed interest in what remains one of the most actively traded meme coins.

⬤ What matters now is whether Dogecoin can hold above those Tweezer Bottom lows. Sustained strength above this level would confirm that DOGE has established meaningful support and could fuel further upside momentum in the coming weeks. If it fails to hold, the bullish signal weakens considerably. For now, though, the monthly chart is showing that bullish momentum is building as Dogecoin stabilizes and claws back recent losses.

Peter Smith

Peter Smith

Peter Smith

Peter Smith