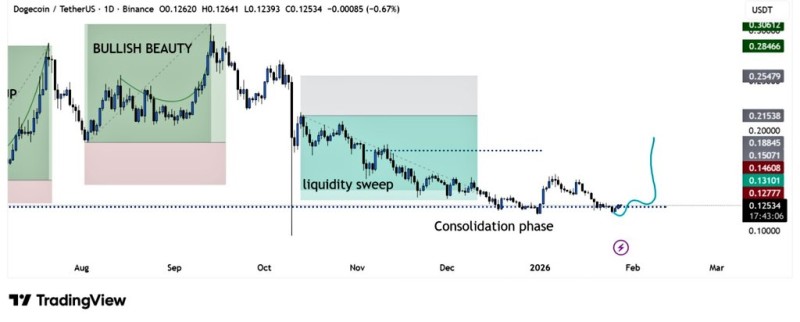

⬤ DOGE has settled into a tight consolidation after a liquidity sweep drove the price into a strong demand zone between $0.12 and $0.13. The sharp decline slowed noticeably at this level, and the price started moving sideways instead of breaking lower. This kind of compression often shows up when selling pressure gets absorbed rather than accelerating.

⬤ The price action shows a clear sequence: an earlier bullish move, followed by a corrective drop that swept stops below prior support, then stabilization. After flushing liquidity, DOGE formed a base and started defending the same demand level repeatedly. Candle sizes have shrunk and volatility has cooled compared to the earlier selloff, suggesting aggressive selling has dried up.

⬤ Right now, DOGE is stuck in a narrow range with flat highs and lows, all while holding above that $0.12–$0.13 demand zone. Overhead resistance sits around $0.18 to $0.20 from earlier price action, but the coin hasn't tested those levels yet. The tightening range signals compression, though it's still consolidation—not a breakout or breakdown.

⬤ This matters because Dogecoin is shifting from volatile selling into a balance between buyers and sellers. If it holds this demand zone after the liquidity sweep, it suggests selling pressure has been absorbed. If it fails to hold, downside risk reopens. How DOGE breaks out of this tight range will signal where the meme coin is headed next.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah