● Joe Swanson recently highlighted a sharp Dogecoin spike after Elon Musk dropped another cryptic tweet. The meme coin rallied more than 25%, showing once again how Musk's social media activity can move markets in minutes.

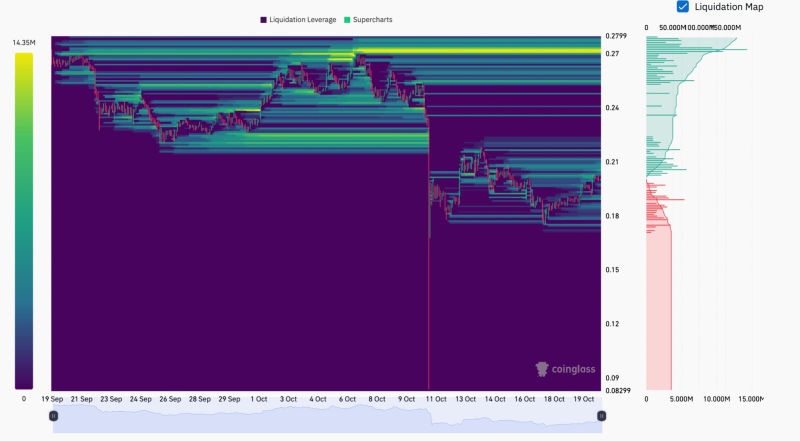

● This surge comes with heavy leverage buildup. CoinGlass data shows major liquidation clusters forming around $0.216—the critical resistance zone. If DOGE breaks through, shorts could get squeezed hard, sending prices rapidly higher. But if momentum stalls, overleveraged longs could get wiped out just as fast. It's a high-risk play on both sides.

● The rally highlights how much social sentiment drives meme coins. Unlike projects with real fundamentals, Dogecoin moves on hype and cultural momentum. Some analysts say this volatility points to the need for better risk management and lower leverage across the board. Still, DOGE maintains strong liquidity, making it a go-to for traders chasing Musk-fueled pumps.

● This isn't new—Musk's Dogecoin tweets have sparked explosive rallies before. Each time, they reignite debates about market maturity and whether influential figures should have this much power over retail trading cycles.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah