Cardano (ADA) is facing mounting selling pressure after whale investors liquidated more than 350 million tokens in just one week. The massive sell-off has sparked concerns about price stability and market sentiment as ADA struggles to maintain key support levels.

Whale Activity and Price Correlation

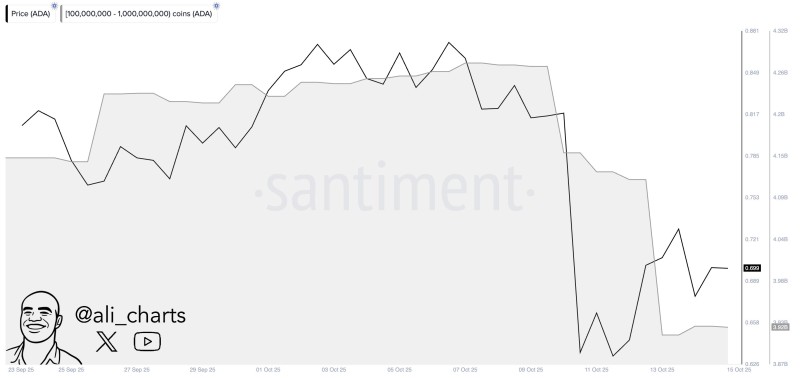

Recent on-chain data from Santiment, highlighted by analyst Ali, reveals that whale wallets holding between 100 million and 1 billion ADA have dramatically reduced their positions. This distribution phase directly aligns with ADA's recent price decline, underscoring how heavily large holders can sway market direction.

The data paints a clear picture: whale balances began dropping sharply in early October, and ADA's price followed suit, slipping below the $0.70 mark during the same timeframe. When whales move, the market tends to follow, and this synchronized selloff confirms that institutional players and high-net-worth investors remain a driving force behind ADA's short-term trajectory.

Several factors may be driving whales to reduce their positions:

- Capital rotation – Investors might be reallocating funds toward Bitcoin and Ethereum, especially with ETF developments capturing market attention

- Competitive pressure – Despite Cardano's ecosystem progress, it's been losing ground to other layer-1 networks in terms of liquidity and developer activity

- Profit-taking – After ADA's rebound earlier in the year, some whales may simply be cashing out gains

Technical Picture

ADA is currently testing critical support around $0.65. If this level breaks, we could see accelerated downside momentum. On the upside, any recovery attempt will face resistance near $0.72–$0.75, where previous rallies have stalled. A decisive push above $0.80 would be needed to shift sentiment back toward bullish territory, but that requires whale activity to stabilize first.

The 350 million token liquidation has left Cardano in a precarious spot. While the project's long-term fundamentals haven't changed, short-term price action will likely hinge on whether smaller investors can absorb the selling pressure from whales. Right now, ADA is walking a tightrope: lose the $0.65 support and deeper losses become likely; hold it, and there's a chance to build a base for the next leg up.

Saad Ullah

Saad Ullah

Saad Ullah

Saad Ullah