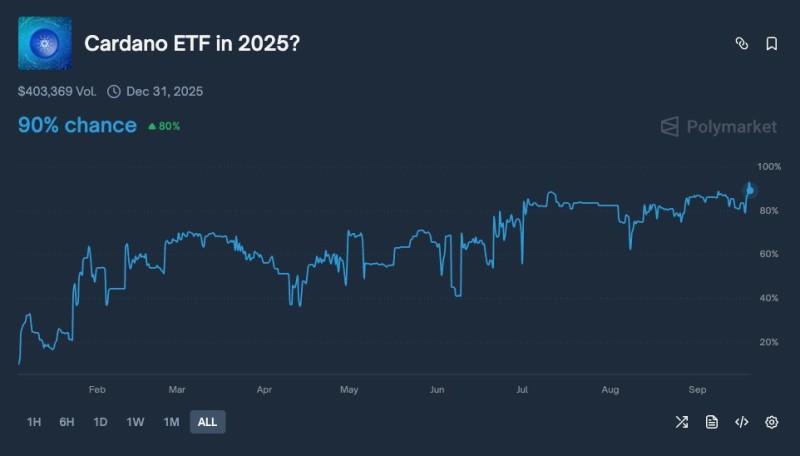

Cardano (ADA) prospects for a U.S.-listed ETF have gained serious momentum in 2025. Polymarket betting odds for approval by year-end now sit at an impressive 90%, marking an 80% jump this year alone. With over $403,000 in trading volume backing this prediction market, there's clear evidence that investors believe ADA could soon join Bitcoin and Ethereum in the regulated ETF space.

ETF Approval Odds and Market Sentiment

The data from Polymarket tells a compelling story of steadily growing confidence throughout the year. What started as cautious optimism has transformed into strong conviction that regulatory barriers are breaking down. The success of spot Bitcoin ETFs and mounting anticipation around Ethereum ETFs appears to be creating a pathway for other major cryptocurrencies. Industry observers, including Cardanians, point out that the 90% projection reflects genuine institutional appetite for ADA as a regulated investment vehicle rather than mere speculation.

If momentum continues, ADA could soon emerge as one of the leading contenders in the race for broader market adoption.

Chart Analysis: The Path to 90%

The betting odds have shown remarkable resilience and growth patterns over the months. Early 2025 saw odds climb rapidly from under 40% to 60% by March, demonstrating initial optimism about regulatory changes. While April and July brought temporary pullbacks as markets digested regulatory uncertainty, each dip was followed by strong recoveries that pushed odds even higher. The September breakout to 90% represents the highest confidence level yet, suggesting that approval isn't just possible but probable.

This trajectory indicates a fundamental shift in how the market views Cardano's regulatory prospects rather than short-lived hype cycles.

Why an ETF Matters for Cardano

The potential approval carries significant implications that extend far beyond simple price movements. An ETF would provide institutional investors with regulated access to ADA exposure, removing many of the operational hurdles that currently limit institutional participation. This expanded access could dramatically increase liquidity as more capital flows into the Cardano ecosystem.

Perhaps most importantly, ETF approval would represent mainstream validation of Cardano as an investment-grade digital asset, placing it in the same category as Bitcoin and Ethereum in the eyes of traditional finance.

Looking Ahead

With odds approaching 90%, a Cardano ETF in 2025 has moved from speculation to serious possibility. The key factors to watch include:

- SEC guidance on altcoin ETF frameworks

- Growing institutional demand for ADA investment products

- Market response as approval odds continue climbing

- Regulatory precedents set by other cryptocurrency ETFs

If approved, a Cardano ETF would represent one of the most significant milestones in the project's development, officially cementing ADA's position in the broader cryptocurrency investment landscape and potentially opening the floodgates for other altcoin ETFs to follow.

Peter Smith

Peter Smith

Peter Smith

Peter Smith