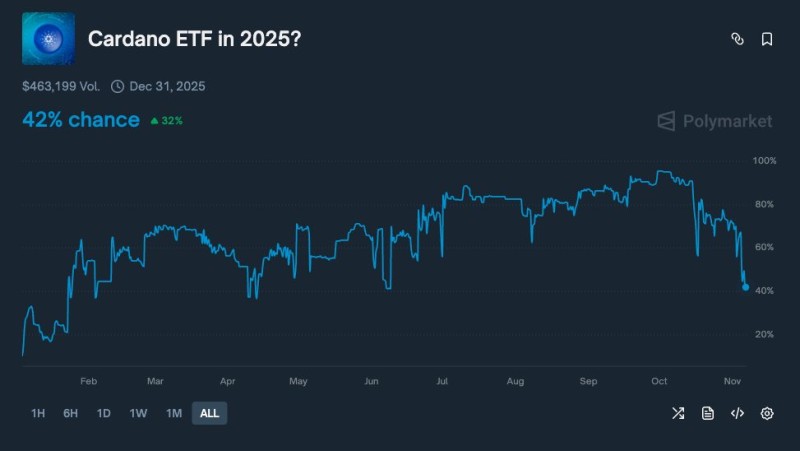

For most of 2025, Cardano ETF optimism was riding high. Polymarket traders consistently priced in 60–80% odds of approval, with brief spikes above 80% during spring and summer. But that confidence has evaporated.

What the Chart Shows

As TapTools recently pointed out, the probability now sits at just 42%—a steep fall that's raising eyebrows across crypto markets. The question everyone's asking: what changed?

The Polymarket data tells a clear story. Early in the year, ADA ETF odds climbed steadily, often testing 70–80%. From May through October, they held in a tight sideways range between 60% and 80%—traders were hopeful but waiting for regulatory clarity. Then came the breakdown. In late October and into November, odds collapsed from above 60% to around 40%, where they remain today. With trading volume over $463,000, this isn't a thin market—it reflects real sentiment shifts among informed traders.

Why the Odds Are Dropping

A few key factors are weighing on Cardano's ETF prospects:

- SEC ambiguity: Unlike Bitcoin and Ethereum, Cardano's regulatory status isn't clearly defined, and the SEC hasn't given the green light signals that would encourage ETF filings

- Shifting narratives: Institutional attention has moved toward Bitcoin ETFs, Ethereum staking products, Solana, and AI tokens—leaving ADA on the sidelines

- Securities concerns: Cardano has appeared in past SEC documents listing tokens with potential securities issues, which creates hesitation

- Cooling on-chain activity: After a strong start to 2025, Cardano's network usage and DeFi growth slowed in Q3 and Q4, potentially dampening institutional interest

Absolutely. Polymarket probabilities are reactive—they can swing fast with the right catalyst. A few things that could flip sentiment back to bullish: approval of other altcoin ETFs like Solana or AVAX, clearer SEC guidance on ADA's status, major enterprise partnerships, a resurgence in Cardano DeFi activity, or favorable U.S. crypto policy changes. For now though, traders are bracing for a longer wait than they expected.

Usman Salis

Usman Salis

Usman Salis

Usman Salis